While the UK pig industry certainly starts 2025 in a better place than in many recent years, there are plenty of issues on the horizon that will shape its fortunes over the next 12 months. We look ahead to what the new year might bring.

The domestic market

If 2023 was all about recovery and recuperation for the British pig sector after a horrific two years, 2024 was a year of consolidation and tentative signs of optimism for the future.

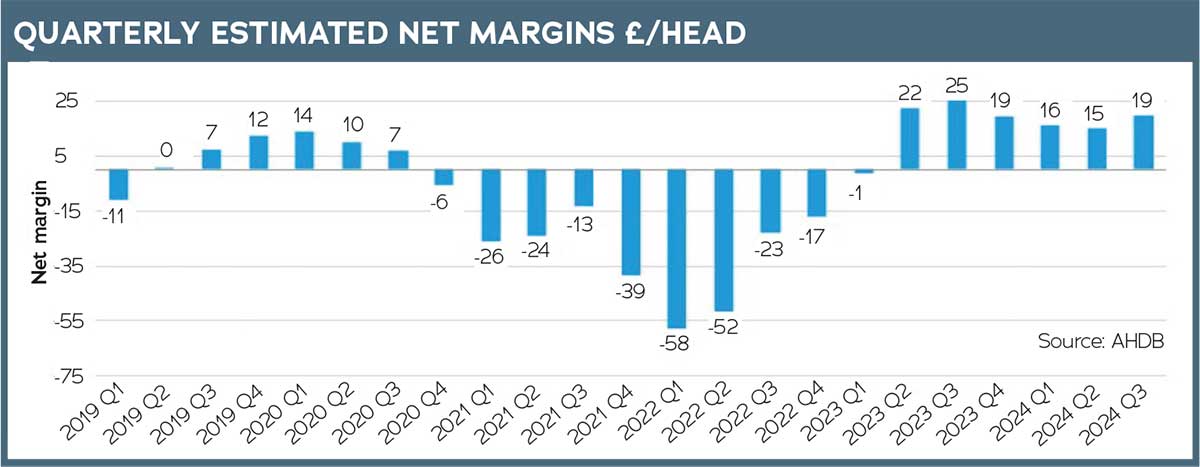

According to AHDB calculations, producers enjoyed positive net margins of £16/head, £15/head and £19/head over the first three quarters of the year, as the domestic pig price stayed remarkably consistent, despite plummeting EU prices, and input costs were steady and manageable, with feed costs falling during Q3.

Even though pig prices dropped back a little, Q4 looks like it’s going to be a similar picture, making it seven successive quarters of profit.

Context is everything, however – the skyscrapers of the past two years don’t yet come close to matching the combined scale of the bars pointing in the opposite direction denoting the crippling losses suffered over the previous 10 quarters.

Although producers are investing again, much of it is in overdue replenishment and with an eye on improving efficiency and welfare and environmental standards, rather than growth.

Indeed, Defra’s June 2024 UK livestock census figures showed only minimal growth in the overall pig herd over the year and a further 3.1% contraction of the female breeding herd to 327,000 head. A 4.6% increase in gilts intended for first-time breeding to 83,700 head hinted, however, at cautious growth to come.

Helped by improved productivity, Defra’s monthly slaughter figures show UK throughputs were 2% up year on year over the first three quarters of 2024, albeit still well below the five-year average, with higher carcase weights helping to drive pigmeat production up by 3.4%. The trend appears to have continued into Q4.

AHDB forecasts UK pigmeat production will end the year up 2.7% at around 951,000t, with the clean pig kill up by 1.5% to 10.2 million head. It predicts slower growth of just 0.9% in 2025, driven by a 0.8% increase in clean pig slaughter.

Industry analyst Mick Sloyan said: “The market stability of 2024 will hopefully continue in 2025, although UK prices could drift lower under pressure from imports. Prospects for the EU are reasonable, with limited growth in production and decent export demand. Continued retailer support for British will be key.”

Restructuring

Meanwhile, the industry has continued to restructure, with, as reported last month, close to 50% of the UK breeding herd now owned by the big integrated companies, as Cranswick, in particular, has continued to grow its herd. With Pilgrim’s Europe also looking to invest in and expand its pig production side, it would be a surprise if this trend didn’t continue in 2025.

2024 also saw a further shift towards longer-term cost-of-production contracts, as the supply chain seeks to secure future supplies of British pork. Look out for more of this early in 2025.

Another huge issue, however, will continue to be labour availability and cost, identified by some businesses as their biggest barrier to growth. Then there’s the weather. Last winter left NPA chairman Rob Mutimer wondering if there is a viable future for the outdoor pig sector if we have many more like it. Let’s hope we don’t.

International outlook

The global sow herd remained steady through Q3 2024, with little sign of expansion, despite improved profitability, as producers remain cautious amid trade, disease and consumption uncertainties, according to RaboResearch. There are, indeed, some big global issues to look out for in 2025.

- Disease: The continued global spread of African swine fever, particularly as it edges, or occasionally jumps, westwards in Europe, poses a real and present danger to the UK pig sector, while outbreaks elsewhere continue to shape global trade flows.

- War and weather: Unexpected global geopolitical and climate events had a massive effect on the pig sector, particularly on the cost of inputs, in recent years. These shocks can happen at any time.

- China-EU trade war: China’s anti-dumping investigation into EU pork products continues into 2025 and its outcome, potentially leading to new tariffs on EU pork, could be very significant if it leaves a surplus of EU pork looking for a home. This would surely outweigh any gains from UK exports filling the gap, even with the welcome lifting of Chinese export restrictions.

- Trump tariffs: Tariffs could be a running theme in 2025 if comments by US president-elect Trump are anything to go by. How much of the rhetoric translates into reality remains to be seen, but with pork such a heavily traded global commodity, new tariffs and counter-tariffs could certainly redirect some global pork trade flows.

Politics and policy

There was plenty of optimism within the farming sector around the new government just after the July election.

After all, in opposition, they had engaged effectively with the industry and said all the right things.

All that hope quickly vanished, replaced by frustration at a lack of action and engagement where it was expected and a sense of anger and betrayal at policies announced in the Budget that threaten to do so much damage to farming.

Here are just some of the policy issues to look out for in 2025:

- Budget furore: As farming protests grow over the damaging inheritance tax reforms, and more detailed analysis highlights the damage it will do to farmers, the government only seems to dig its heels in further. Will anything force it to change tack in 2025? And, for some businesses, the impact on wage bills from national insurance and national living wage hikes is going to be far more damaging.

- Grant uncertainty: No sooner had the government lauded the ‘biggest ever’ farming budget of £5bn over two years, than it was announcing a freeze on many key grant schemes for pig farmers. The industry need clarity on this in 2025.

- Biosecurity failings: We were all hopeful, based on previous comments, that the new government would act quickly to fill the funding shortfall at the Port of Dover for the vital work of intercepting illegal meat imports. While it has moved to close a loophole on personal imports, nothing has happened yet on the more important funding question, although talks appear to be ongoing. The industry also wants a review of the Border Target Operating Model, amid concerns that serious flaws mean products are entering the country via the commercial route without proper checks.

- Fairness in the supply chain: The government has picked up the legislation on contractual practice in the pig supply chain and, after further consultation with NPA and others, this could come into force in the first part of 2025. Can it make a difference and deliver the protection producers need, without too much compromise and without unintended consequences? We should start to find out soon enough.

- Farrowing reform: The government is looking closely at this, as it comes under pressure to act from NGOs, but it has not indicated any timeframe for action. The NPA is proposing a voluntary, industry-led 20-year transition, which it wants to discuss with Defra. Will the government work with it or is it wedded to the idea of legislation to drive this change? And if so, when?

- Method-of-production labelling: If anyone thought this had gone away, they might be disappointed in 2025. Twice shelved, most recently due to the election, ministers have hinted at a comeback, maybe alongside the more popular country-of-origin labelling reform. If so, will the proposals be in a more palatable and workable form? And can they be resisted again?

- New EU veterinary agreement: In the very brief honeymoon period of the new government, there was much talk of a new veterinary agreement with the EU that would remove bureaucracy and break down some of the current barriers to trade. It has gone quiet on this since. It remains to be seen whether progress will be made or if this falls into the ‘empty promise’ category.

- Sustainability and welfare: Questions around sustainability, emissions, pollution and welfare standards will continue to come at the pig sector from all angles. Many businesses have already responded proactively to embrace the challenge – and the pace is certain to pick up in 2025.

- Activism and assurance schemes: 2024 has seen an increased focus on the pig sector by welfare activists, and certain groups have made it clear this will continue in 2025, with the RSPCA Assured and Red Tractor schemes in the spotlight. At the same time, a far-reaching review of farm assurance in the UK is ongoing. Will we start to see change in 2025?