The major UK retailers continued to show steady support for British pigmeat products, according to AHDB’s latest Porkwatch survey.

Overall, across the 10 retailers surveyed, the proportion of British pork on shelves in November was slightly up on September at 88%, in line with a year ago, despite increased price competition from EU imports.

Aldi, Co-op, Lidl, M&S, Morrisons and Sainsbury’s all stocked 100% British, with Waitrose on 99% (100% own label). Tesco and Asda were up 81% and 61%, respectively, with Iceland on just 1%.

The overall proportion of British bacon, at 56%, was slightly down on September, but up on a year earlier. Co-op and M&S ere the only two retailers displaying 100% British, with Waitrose on 92%.

A total of 62% of ham on retail shelves was British, similar to September and slightly up on November 2024. M&S, 96%, Co-op, 96%, Waitrose, 86%, and Sainsbury’s, 81%, led the way.

The November figure for sausage, 78%, was in line with September and a year ago, led by M&S, 100%, Aldi, 95%, Waitrose, 94% and Lidl, 92%.

Retail sales

Data from Worldpanel by Numerator UK, summarised by AHDB, showed, in the 12 weeks to November 30, overall retail pigmeat volume sales increased by 1.6% year on year, with value up 3% on the back of a 1.4% average price increase.

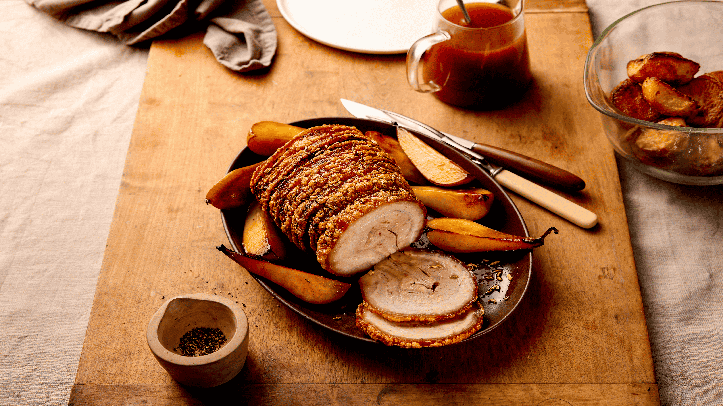

Primary pork volumes were up 2.9%, with value up 5.8%. There were increases seen for belly (+2.2%), fillet (+12.9%), mince (+38.9%), ribs (+3.6%), and roasting (+2.2%).

Processed pig meat saw a 1.9% volume increase over the 12-week period, with spend 1.4% up. Sausages (+2.9%), sliced cooked meats (+0.8%), and gammon (+8.4%) all saw volume increases which offset declines seen by other processed cuts.

Total added value products saw an 5.4% increase in volumes, driven by sous vide performance, which saw a 17.8% increase in volumes purchased year-on-year.

Spend on beef increased by 10.8%, driven by an 19.3% increase in average price, as volumes purchased declined by 7.1%, helping to drive the pork increase.

Lamb retail volumes declined by 7%, accompanied by a 1.7% decrease in spend year-on-year, as average prices paid increased by 5.7%.