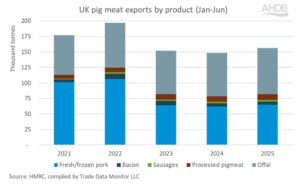

UK pig meat exports have continued to strengthen year-on-year (YoY), totalling 156,400t in the first six months of 2025. This is a 5.2% (7,700t) increase on 2024 and up 3.0% (4,500t) compared to 2023.

Volume growth in 2025 has been primarily driven by shipments of offal (+6.5% YoY) and fresh/frozen pork (+5.0% YoY), although sausages have also seen a small uplift (+400t YoY). Bacon exports, however, have declined year-on-year (-300t) and shipments of processed pigmeat have remained in line with those recorded last year.

At 74,700t, UK pig offal exports in 2025 so far (January-June) stand at a record high and make up 48% of the UK’s total pig meat export basket. China is the top destination for this product, taking in 62%.

Improved demand within the Chinese market and the fallout between the US and China over trade tariffs, has benefited UK exporters so far this year. Other key destinations for offal include the EU27 (20%), Philippines (9%) and Dominican Republic (2%).

After two years of decline, there was some recovery in fresh/frozen pork exports in the first half of 2025. However, at 65,000t, volumes remain well below historical records.

The EU27 continues to be the main destination for this product, with 30,000t shipped to the continent so far this year, virtually unchanged year-on-year. Germany, Ireland and France are the primary receivers.

China also takes in a significant amount of fresh/frozen pork from the UK (23,600t) and has been driving the growth in overall shipments, alongside the Philippines. There has been a small decline in in shipments to the US, likely impacted by changing trade tariffs.

Imports

UK pig meat imports totalled 370,900t during the first half of 2025. This is a decline of 4.4% (17,200t) compared to H1 2024 and the lowest import volume record since 2021.

In 2021, the end of the Brexit transition period brought significant disruption to trade flows in the first quarter. In 2025, the outbreak of foot and mouth disease in Europe impacted trade in January, but unlike 2021, volume has not recovered through the second quarter (Q2).

AHDB said that despite improved domestic pig meat demand and increased EU pig meat production, it is likely that a narrowing of the gap between UK and EU reference prices through Q2 made EU product appear less attractive on a cost basis to UK buyers.

All product categories have recorded decline, but fresh/frozen pork and sausages were the most significant, losing 7,600t (-4.6%) and 3,800t (-4.9%) respectively.

Germany has accounted for much of the UK’s lost import volume, with shipments down 39% year-on-year, primarily made up of fresh/frozen pork and sausages. Much of this volume loss was seen in the Q1 following the outbreak of FMD.

However, despite regaining full UK market access in Q2, German shipments have remained lower year-on-year. The UK has also imported less pig meat from Denmark (-2%) in H1 2025, all accounted for within the bacon category.

There were large import increases for fresh/frozen pork from Belgium (5,700t) and Spain (5,100t), as well as an uplift in bacon from Ireland (2,000t). However, these gains were not enough to counter the heavier volume losses.

Although new duties imposed by China on the EU may provide export opportunities for the UK, it may also lead to an increase in import volumes in the coming months. Despite most EU pig meat shipped to China not matching UK domestic consumption preferences, it is likely to cause downward pressure on pricing across the market.