AHDB analysis has shown that, for the first six months of the year, imports and exports of pig meat in the UK are in year-on-year decline.

Exports

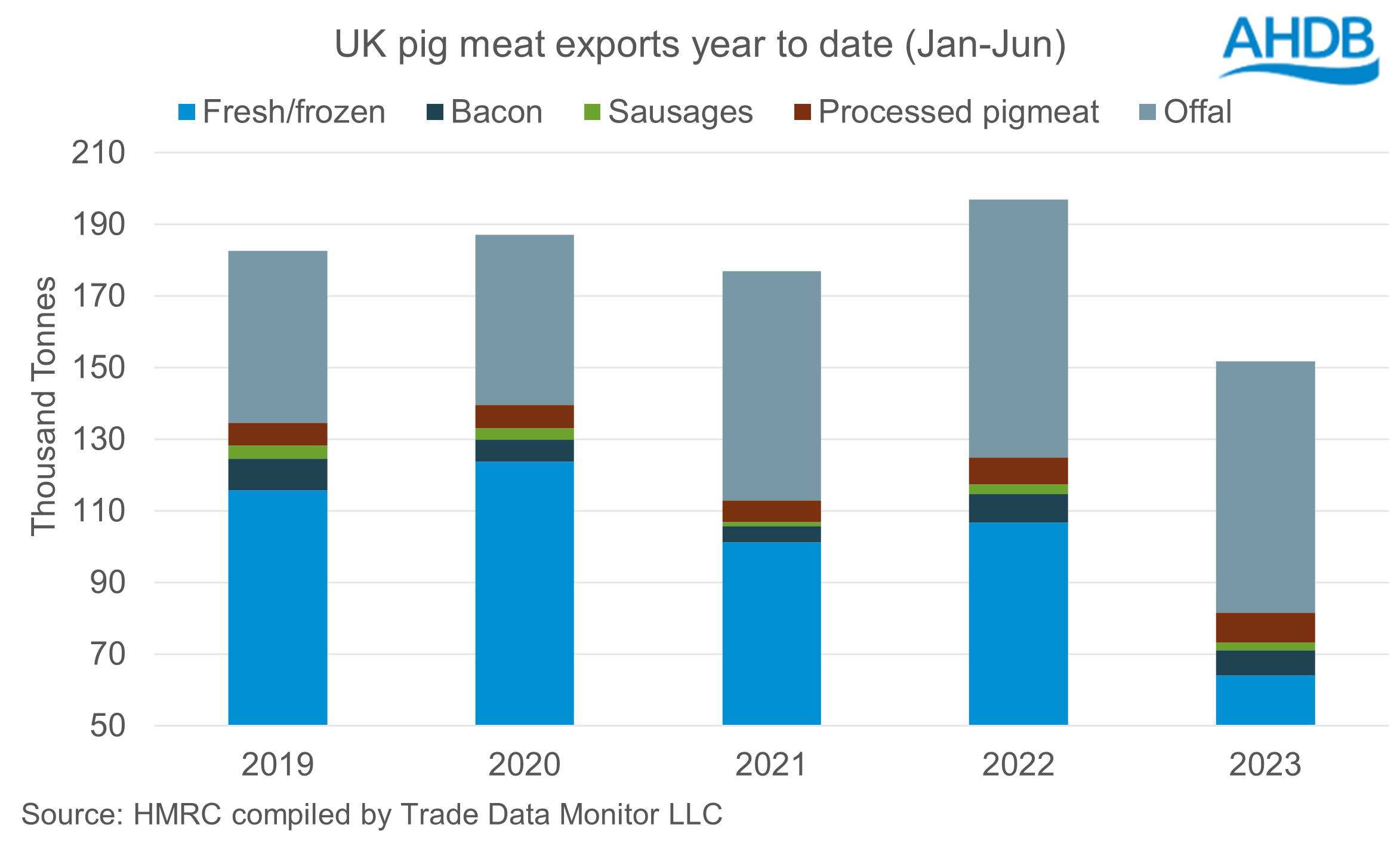

Whilst pork exports in June saw a small increase (+200 t) from May, there is a 15% decrease compared to June 2022. Total pig meat exports for the six months of the year are at the lowest levels since 2015 (151,800 t).

Senior analyst at AHDB, Freya Shuttleworth, explained: “In the first six months of the year, all product categories have seen year-on-year decline, except for processed pig meat where volumes have increase by 1,000 t in 2023. The overall decline in export volume is driven by a dramatic fall in fresh/frozen pork. Volumes for this category are at their lowest since 2010, totalling 64,000 t Jan−Jun, a year-on-year decline of almost 43,000 t (40%).

“The significant reduction in domestic production will be a dominant force behind this substantial change, paired with high pig prices reducing the price competitiveness of UK product. Exports of offal, bacon and sausages have recorded smaller declines of 1,900 t, 1,000 t and 500 t respectively.”

Exports to the EU have seen a 26% (-23,400 t) decline year-on-year, with consignments to the wider world down by 39% (-18,300 t). In contrast, China has only seen a small reduction of 6% (-3,500 t). Ms Shuttleworth explained: “This more subdued decline in shipments is down to 61% of imported product from the UK being made up of offal. Volumes of offal shipped to China have grown 16% year on year while volumes of fresh/frozen pork have declined by 26%.”

Imports

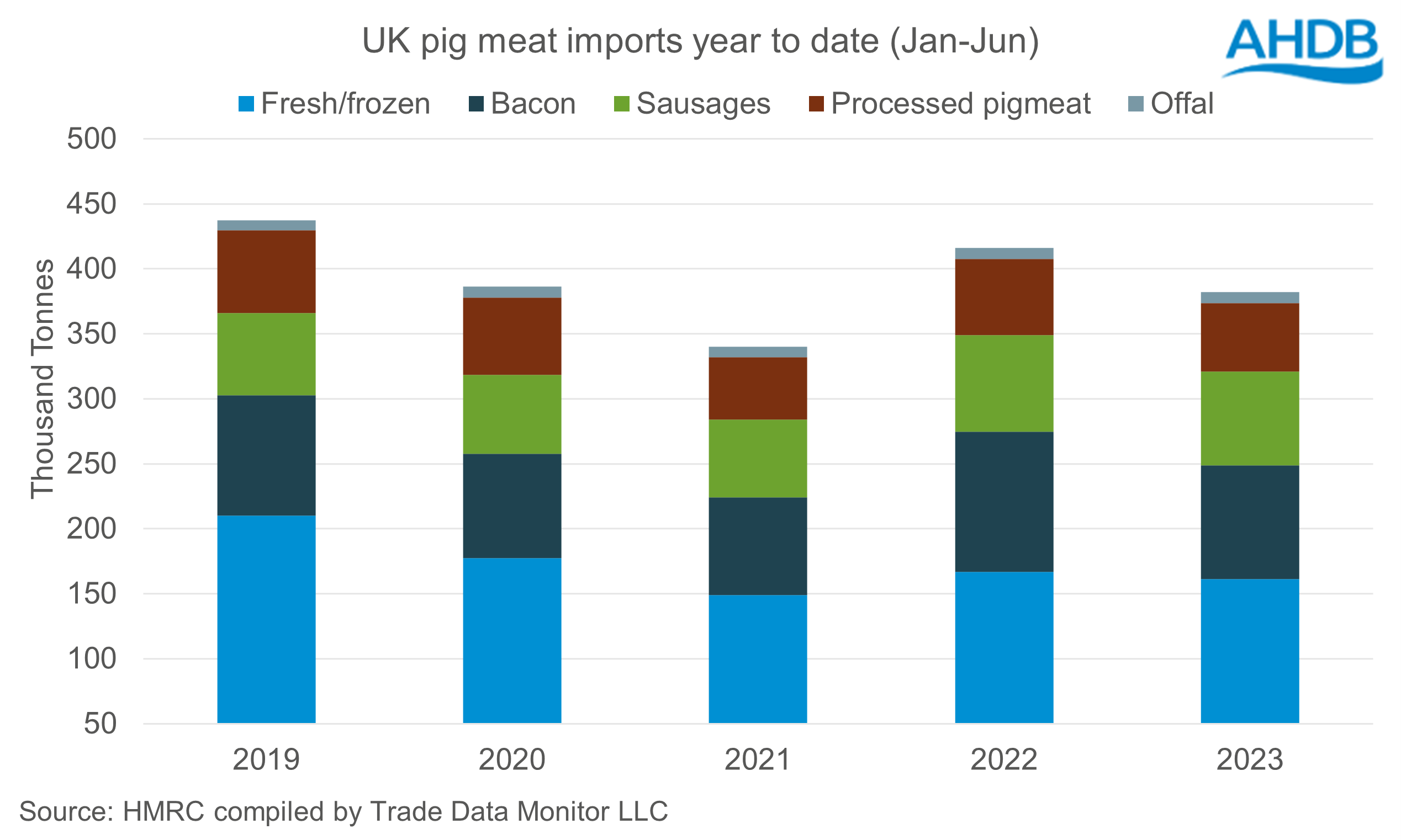

UK pork imports in June saw a year-on-year increase of 5,000 t, however year to date (Jan-Jun) imports saw a decrease of 8% (-34,300 t) at 381,900 t. Of these declines, bacon saw the largest (19%) decrease, while processed pig meat was down by 10% (6,000 t), fresh/frozen pork by 3% (5,500 t) and sausages by 3% ( 2,100 t) compared to last year’s volumes.

Ms Shuttleworth explained that the declines in imports is due to a number of factors: “European pig meat production for the year so far (Jan−May) is sitting 9% behind last year, following a similar trend to the UK, limiting the amount of product available for export on the continent.

Ms Shuttleworth explained that the declines in imports is due to a number of factors: “European pig meat production for the year so far (Jan−May) is sitting 9% behind last year, following a similar trend to the UK, limiting the amount of product available for export on the continent.

Added to this, European pig reference prices have seen significant upwards movement since the new year. This has closed the price differential between UK and EU product, making EU imports to the UK more expensive. On top of this, consumer demand remains negative due to the cost-of-living crisis with volumes of pig meat purchased in retail down 2.5% year-on-year (52 weeks ending 9 July).”