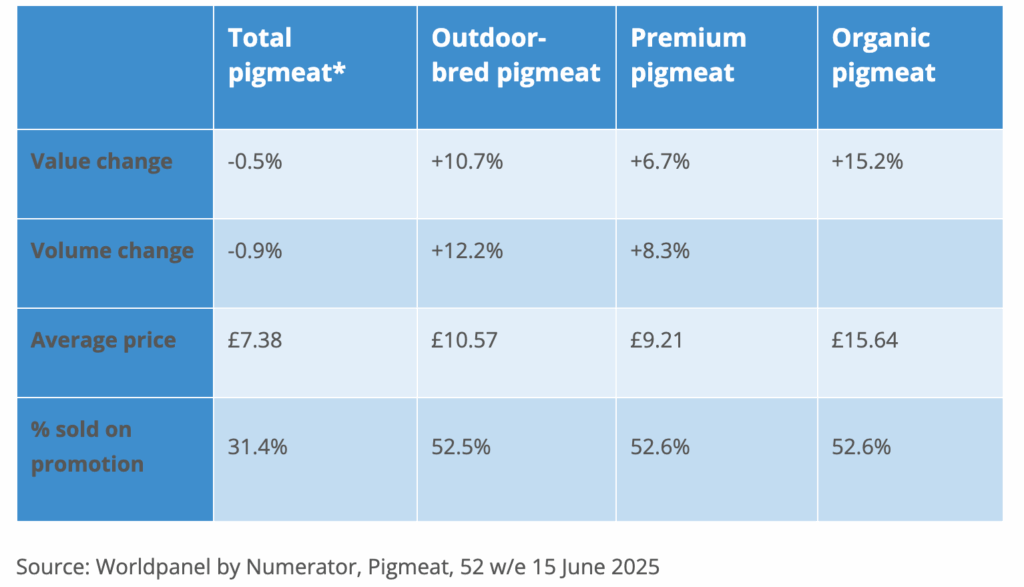

Outdoor-bred pigmeat sales continues to grow, with volumes up by 12.2% in the year to June 15, according to data from Worldpanel by Numerator.

According to AHDB lead retail insight manager Grace Randall, the increase is driven by both consumers wishing to trade up to premium ranges and promotions delivering good value for money.

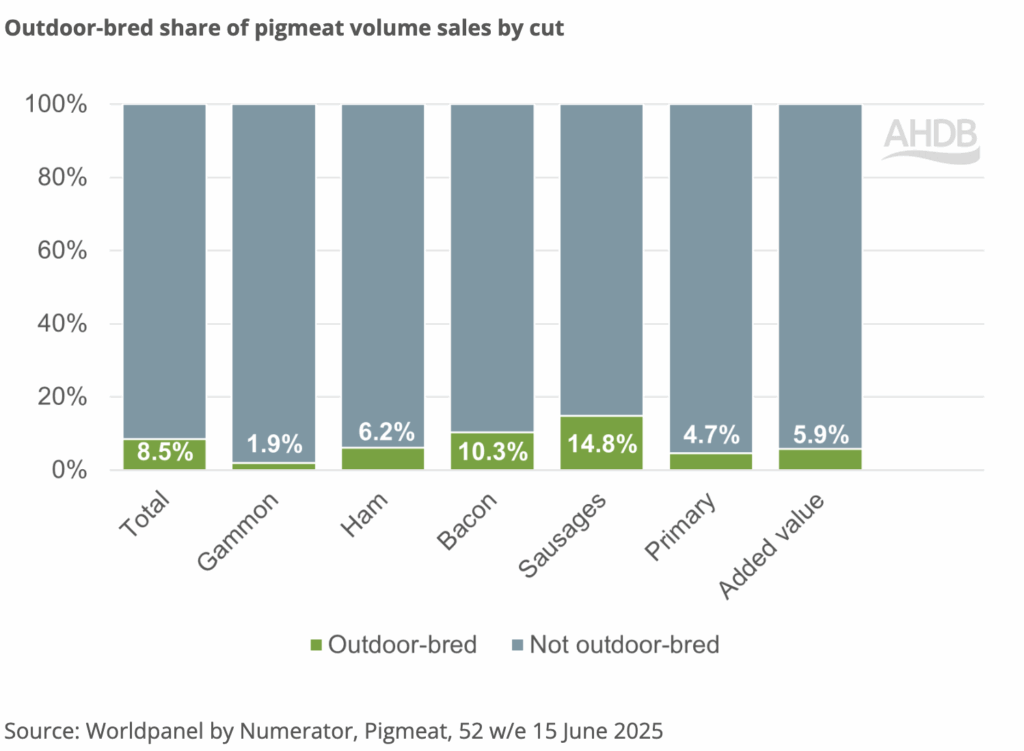

Analysis by AHDB with Numerator shows outdoor-bred pigmeat has an 8.5% share of pigmeat retail volumes, so it remains a small but important part of the market. Outdoor-bred volumes increased at different rates within the different cuts of pigmeat, while average prices have declined by 1.3% over the last year, making it feel better value for shoppers.

This is likely to be due to an increase in promotions, with sales through promotions up by 0.4ppts to 52.5% for outdoor-bred pigmeat in the last year.

Half of outdoor-bred pigmeat sales are within premium ranges. However, the number of shoppers who claim they always or try to, where possible, buy outdoor-bred pigmeat has remained the same year-on-year at 26% (AHDB/YouGov May 2025).

“Therefore, the boost in sales is potentially a move towards premium pigmeat, rather than a specific desire from consumers to purchase outdoor-bred pigmeat,” Ms Randall said.

Premium ranges, such as Tesco Finest and Sainsbury’s Taste The Difference, have been bouncing back, with premium range sales up by £1.8bn in the last two years, according Worldpanel by Numerator.

“For some shoppers, pressures on wallets have eased slightly, while others have taken advantage of an increase in promotions at some retailers. However, many consumers are still watching what they purchase, with some shoppers switching out of and into pigmeat. Both of these trends combined have given outdoor-bred pigmeat a boost,” Ms Randall said.

Cut insights

Sausages, bacon and ham outdoor-bred pigmeat volume sales have increased faster than premium, while primary and added value see greater growth in premium. This shows there are opportunities in these areas to boost outdoor-bred pigmeat’s credentials, Ms Randall added.

Sausages, the most important outdoor-bred cut, account for 45% of outdoor-bred pigmeat sales. Outdoor-bred sausages have seen growth across many retailers and brands – particularly boosted by new ultra-premium sausage SKUs (stock keeping units).

Ultra-premium sausages have gained over a million shoppers despite their short time on shelves and are classed as one of the best NPD of the year by Worldpanel by Numerator. However, not all of these are exclusively outdoor-bred pigmeat; therefore, which could be an opportunity, Ms Randall said.

She said there was also a a good opportunity for outdoor-bred pigmeat to boost its presence in the growing ‘value added’ area, especially in growing segments like sous vide and marinated products. “There have been many new products entering the market, and it also has a more premium feel, but it under-indexes for outdoor-bred pigmeat,” she added.

“These products have a similar price point to the average outdoor-bred pigmeat price, so the potential trade up could be less of a barrier and therefore more enticing to shoppers. BBQ ranges primarily fall within added value, and these are also an opportunity for outdoor-bred pigmeat.”

All primary cuts have seen growth year-on-year for both outdoor-bred and primary cuts, a much stronger performance than standard pork cuts. Top-performing outdoor-bred primary products are among a range of cuts, but the majority are premium SKUs.

“Therefore, highlighting the quality and taste credentials is important on pack to communicate the benefits of outdoor-bred products to consumers. To see more on how to optimise packaging, see our labelling research,” Ms Randall said.

“However, there is still headroom for outdoor-bred pork. The areas to focus on are steak and belly, where there are opportunities for growth, as premium is growing faster than outdoor-bred.

“Other areas of opportunity could be when consumers are looking for a treat or to trade up. These could include supermarket counters, part food or food-to-order options, where consumers may purchase meat for special occasions and for guests.

“Here, consumers are looking for quality and taste credentials so communicating how outdoor-bred could meet these needs could boost appeal.”

Changing definition

AHDB’s outdoor-bred pigmeat definition has expanded from previous years to include added value products such as marinades and sous vide, although, the share of outdoor-bred pigmeat in these products remains small.

Therefore, this year’s data is not comparable to previous years. Within outdoor-bred, it includes outdoor-bred, outdoor-reared, free range and organic products, as all of these are pigs which are born outside. As in previous years, it has included products that are not of British origin and hold an outdoor claim.