The latest Rabobank quarterly pork report has revealed gains in production and weaker consumption, pressuring the global pork markets and trade.

Industry optimism has increased due to lower feed costs, better animal health and improved productivity.

Disease pressure is still an issue in some regions, but overall herd health has improved. Christine McCracken, senior analyst-animal protein at Rabobank, said: “A renewed focus on cost reduction – given inflationary pressures resulting in the elimination of less productive operations – is also contributing to a rebound in production per sow. Although this improvement is a welcome trend and lowers costs, the additional production is compounding regional oversupplies and weighing on the market.”

Breeding herd reductions in most geographies outside Europe and South Korea are slow, despite ongoing margin pressure and limited optimism for a quick turnaround in global trade.

Feed Prices

Feed Prices

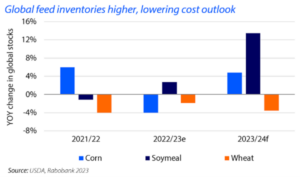

Corn and soybean prices reduced in the third quarter of 2023, after a good North American harvest helped rebuild stocks and expectations for a large South American crop emerged. Oilseed yields remain below pre-Covid levels and leave little margin for error. Feed costs are now down 20% to 30% year-on-year in most locations.

“With the emergence of an El Niño pattern, the focus will shift to potential impacts on the South American growing season,” added Ms McCracken. “And while grain and meal prices are expected to remain lower, other rising costs – including labor, insurance, and financing – remain high for most producers.”

Consumption

Pork remains a dietary staple and overall consumption trends remain stable. However, pack types and sales channels continue to shift.

Ms McCracked said: “With consumers still cautious, particularly in light of rising geopolitical uncertainty, we expect an ongoing focus on reducing spending. Pork consumption should benefit from the high cost of competing proteins and more consumers cooking at home.”

Recent global events add further uncertainty to energy and financial markets and could influence consumers through the end of 2023 and in early 2024, even as the underlying economic environment continues to recover. Rabobank reports that it expects steady consumption in 2024 on lower pork prices and the benefit of high-cost competing proteins.

Imports

July and August saw the pork trader slow, compared to last year, as costly EU pork exports and relatively high frozen pork inventories in many key importing countries weighed on demand. Global pork importers remain cautious given disappointing demand, currency volatility, and rising geopolitical risk.

Ms McCracken concluded: “In the final quarter of 2023, we expect global trade to remain slow given large inventories, relatively high domestic production, and low pork prices in key importing regions. Rising EU pork prices may also limit export volumes.”