Falling feed costs drove a healthy increase in average net pig farm margins during the second quarter of 2025, according to the latest update from AHDB.

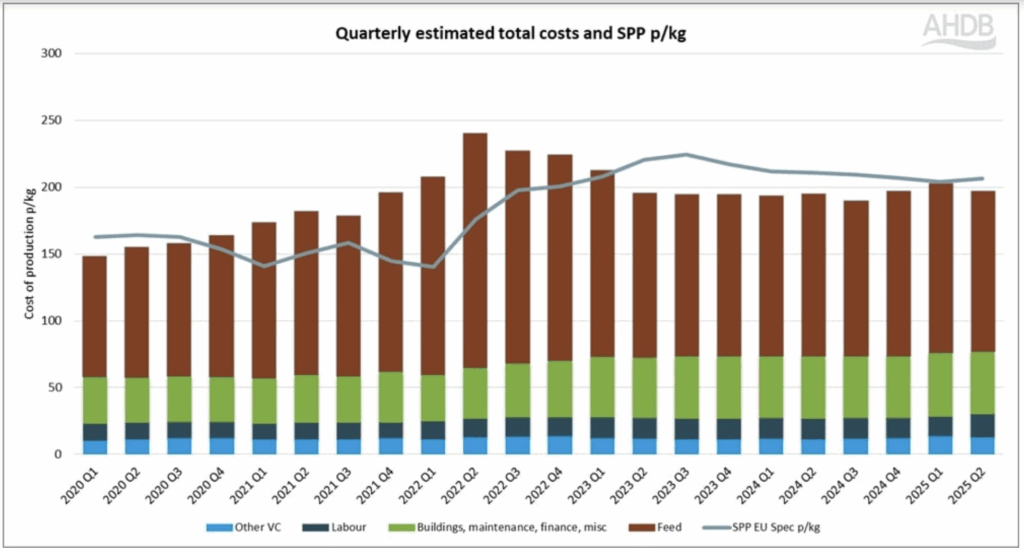

Q2 feed costs fell by 7p to 120p/kg, making up an estimated 61% of total costs. Average feed costs hit a high of 175p/kg during Q2 2022, accounting for 73% of total costs, but since Q2 2023, have ranged between a more manageable 116-127p.

Finance costs and fuel prices also fell during Q2 – however, this was offset by an increase in labour costs.

The AHDB estimates, which use performance figures for breeding and finishing herds, put the full economic cost of production for Q2 2025 at 197p/kg deadweight, 6p below the Q1 figure.

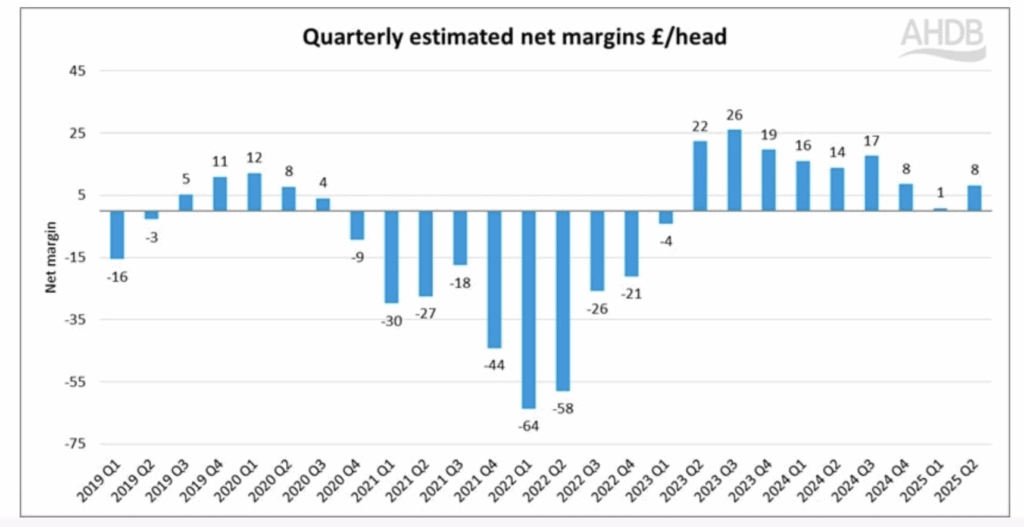

Meanwhile, pig prices, as measured by the SPP, increased by 2p during this quarter to around 206p/kg (SPP). This resulted in margins of £8.10 per slaughter pig and 9p/kg deadweight.

This was up from just £1/head in Q1 2025 and in line with the Q4 2024 figure. There have now been nine consecutive quarters of positive margins, following the 10 consecutive quarters of debilitating losses that were estimated to have cost the industry in excess of £700 million.

From the start of 2025, the cost of production and net margin figures have been calculated using the SPP price instead of the APP as it has been continued, which results in slightly lower reported margins.

The SPP has continued to rise slowly since the start of Q3, while feed costs have remained relatively low, suggesting pig farmers will remain, on average, comfortably in the black.