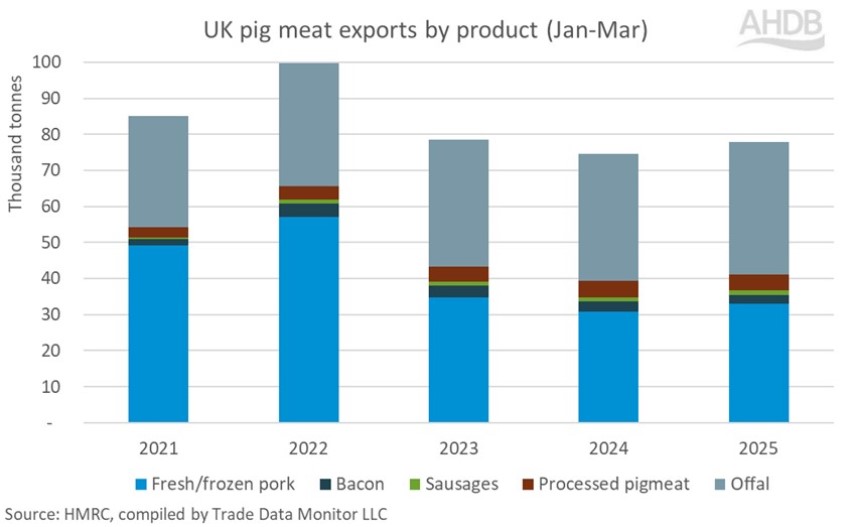

The volume of UK pork exports in the first quarter of 2025 increased by 4% year on year, driven by higher volumes to China.

A total of 77,800 tonnes of pigmeat was exported in the first three months of 2025, with all product categories except bacon recording volume growth.

Shipments of offal remain the largest contributor to the export basket at 36,700t (47%), with the majority of this product (22,100t) sent to China. Despite volume to China increasing by over 3,000t (18%), overall category growth, up 4%, was more muted shipments to the Philippines fell by over 1,000t (26%).

Fresh and frozen pork exports grew year on year for the first time since 2022, up 2,000t to 32,900t in Q1. Although the EU27 is the main destination for this product (48%), growth in the category was driven by increased shipments to China.

The higher volumes heading to China has no doubt been helped by the return of China export licences to two major UK pork plants in December.

Exports of bacon have been steadily declining for the last couple of years, with Q1 2025 volumes back 5% compared to the same period last year. 97% of this product goes to the EU27 with the decline driven by Ireland and Germany. On the contrary shipments of processed pig meat have been picking up (1%) with Ireland the key destination, according to AHDB senior analyst Freya Shuttleworth.

Imports:

In contrast, pigmeat import volumes, at 180,500t, fell by 1%, 1,800t, in Q1. Bacon was the only category to record growth, up 3% year-on-year to 42,600t, while fresh & frozen pork held steady at 77,500t, continuing to hold the largest market share (43%). However, declines in processed pig meat and sausages of 1,300t each drove the overall trend.

Impact of FMD in Europe:

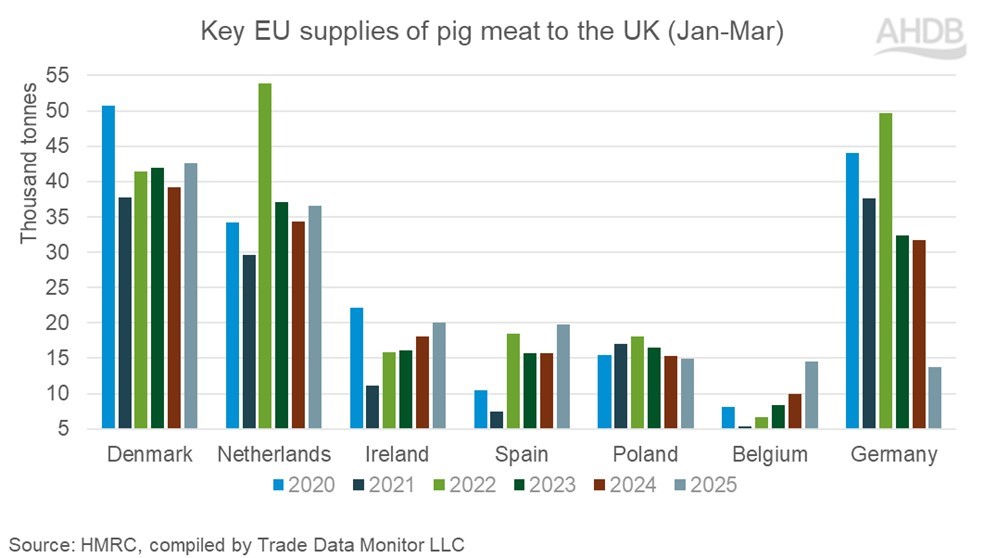

The confirmation of foot and mouth disease (FMD) in Germany on January 10 initially had a significant impact on trade flows.

“The UK saw significant year-on-year decline in both imports (-8%) and exports (-13%) of pig meat that month as Germany lost its export licence to the UK, resulting in more product availability within the European market and additional pressure on pig prices. However, trade volumes in February and March picked up as supply chains adapted to the new supply base,” Ms Shuttleworth said.

The EU27 accounts for over 99% of pig meat imports to the UK. Over the last five years (2020-2024) Germany has been constantly in the top 3 trade partners, with Q1 shipments averaging 39,100 t. This is a stark contrast compared to 2025, where Q1 volume reached just 13,800 t, placing Germany as the UK’s seventh largest supplier, she added.

Changing supply bases have meant significant volume increases from other key trading partners. Belgium, Spain and Denmark have seen volumes up 4,500t, 4,200t and 3,300t on the year respectively, while the Netherlands and Ireland have recorded an increase of around 2,000t each.

Germany was granted regionalisation by the UK government on March 24, allowing trade from outside the containment zone to resume. As of 14 May, Germany is recognised as FMD free without vaccination by the UK, meaning all trade restrictions associated with the disease have been formally removed.