The outlook for a large cereal harvest has been confirmed, resulting in declining grain prices.

AHDB has reported that European oilseed rape production is expected to be the lowest since 2006/07. Prospects of tighter supplies, along with some currency support has driven up UK oilseed rape prices.

Grains

The UK harvest has been well underway throughout August and the outlook for a large cereal harvest has been confirmed. Although there is still some way to go until harvest 2019 is complete, it is unlikely that prospects will alter dramatically towards the end of harvest.

As a result of good prospects, grain prices have dropped.

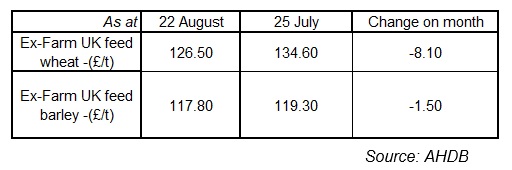

UK Ex-farm feed wheat (August delivery) has lost £10.80/t over the month. Meanwhile, UK ex-farm feed barley (August delivery) has also dropped but to a lesser extent, falling £1.80/t over the month.

The release of the USDA supply and demand estimates (WASDE) report in early August revised figures for US cereal crops, pushing markets lower. US corn (maize) production was revised up, at 353.1Mt, well above trade expectations.

On the day of the WASDE release US maize futures (Dec-19) crashed to the lowest possible point in a day and US wheat futures (Dec-19) also fell 5%. UK and Paris wheat futures both dropped but to a lesser extent, with little time to react before UK trading closed.

Over the month, UK feed wheat futures (Nov-19) and US grain futures (Chicago maize and wheat Dec-19) have moved lower. UK feed wheat futures (Nov-19) lost £12.50/t over the month closing on Friday 23 August at £133.50/t.

UK feed barley purchases have hit a record high for July and August with cumulative spot purchases of feed barley reaching 290.4Kt. Large old crop carry-out, large new crop prospectsand Brexit uncertainty will all be contributors to this.

Barley usage in animal feed production (compound and integrated poultry units) increased towards the end of the season (July – June), up by 12% from May to June 2019. This is up 23% compared to June 2018.

Wheat usage also increased from May to June (18%) whereas Maize only increased 3%. Imported maize is still relatively expensive compared to UK feed wheat or barley which could support demand for domestic grains. However, if maize prices continue to fall it could become more competitive and increase its presence in animal feed rations.

Proteins

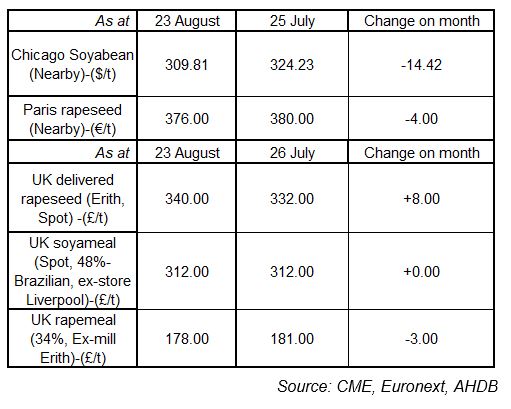

Both UK and wider European oilseed rape production is significantly down year-on-year. The latest USDA WASDE estimates EU production at 18Mt, the lowest since 2006/07. This supply outlook, along with some currency support has seen physical UK oilseed rape prices (delivered into Erith, November) rise by £8.00/t since the end of July, to £349.50/t on 23 August.

European rapeseed futures (Nov-19) rose considerably early in the month, before falling back by €4.00/t on Friday 23 August. Pulled lower by Chicago soyabean prices. Chicago soyabean futures (Nov-19) have been a little more variable from the beginning of August but have dropped $3.21/t to 23 August.

The USDA WASDE reported US soyabean area and ultimately production below trade estimates but the market reaction was short lived. Despite lower 2019/20 production estimates, old-crop stocks remain large. With no resolution between china and the US, trade is slow and high carry-out of old-crop is looking likely.

Currency

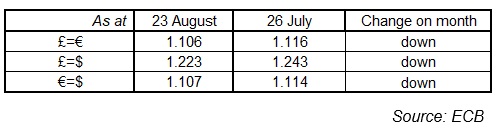

The value of sterling against both the euro and the US dollar continued to drop to long-term lows into early August. Since then sterling has strengthened somewhat, to slightly higher than the start of the month. The low value of sterling has meant UK pricing is seemly competitive an export market against other grain producers. This has supported UK physical prices.