UK pig meat exports decreased by 9% in the third quarter of this year, compared with Q2, although, over the course of the year, 2025 exports volumes remain above 2024 levels.

September export volumes, including offal, fell to 22,300 tonnes, the lowest monthly volume since January 2025, according to AHDB.

Across Q3, the 9% (7,000t) drop compared to Q2 was driven by substantial decreases in shipments to China (-5,100t), relecting its short-term refocus on self-sufficiency and reports suggesting that Chinese consumer demand is below expectations currently, and Ireland (1,800t).

Despite the quarterly decline, Q3 exports were only 1% lower year-on-year (YoY) indicating that the broader export position has remained stable compared to 2024.

However, UK pig meat export volumes for the year to September were up by 3% (6,800t) YoY at 228,100 t. This growth was largely driven by China (+16%; +13,600t YoY), more than offsetting declines elsewhere, including to the EU (-4%; -3,800t) and the Philippines (-6%; -1,000t).

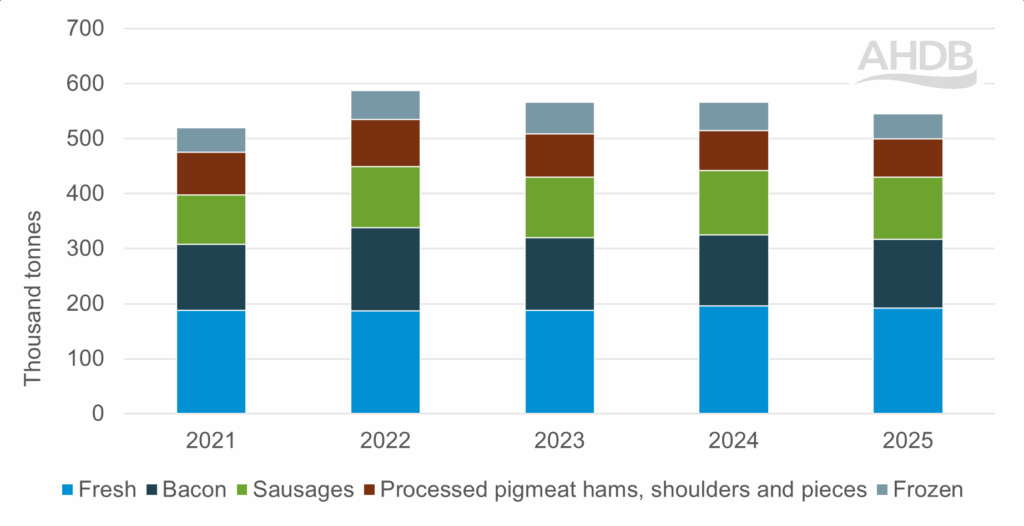

Product trends

Fresh and frozen pork exports grew by 4% YoY, with shipments to China up by 12% (3,700t) and to Denmark by 64% (1,100t), helping to offset a decrease of 22% (3,300t) to Ireland.

Meanwhile, sausage exports recorded a modest rise (628 t), whereas bacon and processed pig meat fell by (900 ) and (600 t), respectively.

UK pig meat exports by product (Jan–Sep) (incl. offal)

Source: HMRC, compiled by Trade Data Monitor LLC

UK offal exports stood at 109,400 t in the year to September, with China accounting for 61% of total shipments, as volumes grew by 18% (10,000 t) YoY, likely supported by ongoing trade tensions between China and other nations, notably the US and EU, according to AHDB. EU exports of offal to China fell by 27% YoY in September, coinciding with the introduction of anti-dumping duties.

UK offal exports to the Philippines decreased by -14% YoY, potentially linked to increased Brazilian competition over the same period.

Meanwhile, UK offal exports to the EU declined by 9% YoY (2,200 t) decreasing the EU’s market share of UK offal trade from 23% in 2024 to 20% in 2025. This decline likely reflects the widening price gap between EU and UK pig prices throughout Q3, weakening UK export competitiveness, AHDB said.

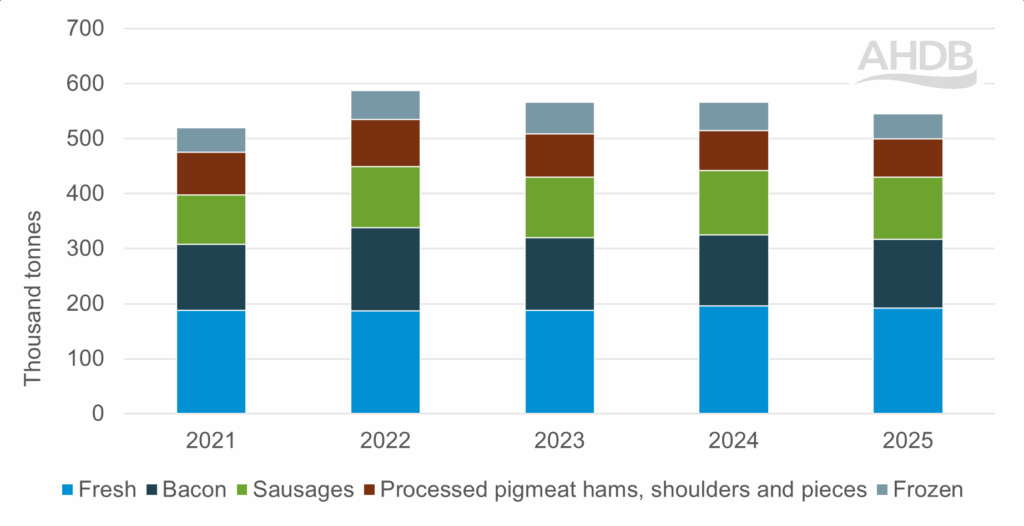

Imports

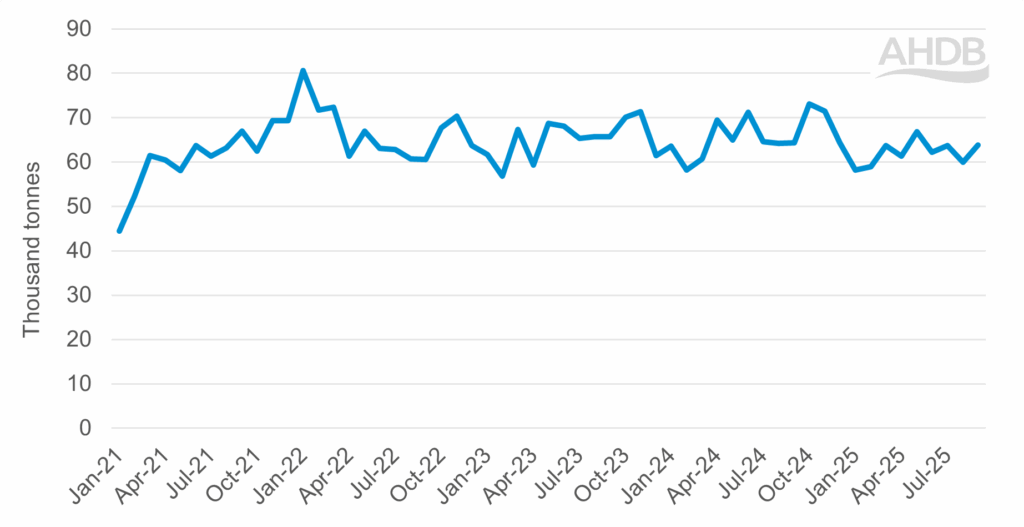

Despite some monthly fluctuation, UK pigmeat imports (including offal) remained lower year-on-year through Q3, at 187,500t, down 3% (-5,700t) on the year. Volumes remained lower from Germany and the Netherlands in particular, while Denmark saw growth.

In the year-to-date, volumes decreased by 4% (22,600t) YoY totalling 558,700t, the lowest level for the nine-month period since 2021.

Imports of all headline categories decreased year-on-year in Q3; with fresh and frozen and sausages declining by -4% (9,900t) and -3% (3,800t), respectively. Bacon was also down 3% (3,500t), driven by a 15% decline from Denmark, marginally offset by Ireland which increased by 77% (3,600 t).

UK monthly imports of pig meat (including offal) (2021–2025)

Source: HMRC, compiled by Trade Data Monitor LLC

Imports of fresh and frozen pork from Germany fell sharply, down -45% (24,600 t) YoY, while German sausage imports declined by -12% (4,200 t) YoY. In contrast, imports of fresh and frozen pork from Belgium and Spain rose by (6,900 t) and (5,600 t), respectively.

Germany has since regained market access to the UK following an outbreak of FMD, and import levels have begun to recover. However, for the year-to-date German imports were down 29% YoY (30,300 t), reducing its share of UK imports to 13% from 18% last year, AHDB noted.

Belgium and Spain saw the biggest increases in imports to the UK, up 18% and 11% YoY, respectively.

UK pig meat imports by meat type

Source: HMRC, compiled by Trade Data Monitor LLC

EU-UK pricing

In July, the difference between EU and UK pig pricing reached its narrowest point since mid-August 2024, potentially driving some decline in imports for August 2025, which totalled 59,900t, down from 63,700t the previous month.

Additionally, data from AHDB’s Porkwatch country-of-origin audit points to sustained retailer support for domestic product through this time.

However, since October EU pig prices have seen a sharp decline, driven by changes in demand and stronger-than-expected production levels, increasing import competitiveness.