The latest Rabobank quarterly pork report raises concerns for the global pork industry. Despite indications that inflation is slowing, the impact is likely to be felt throughout the industry in 2023.

Pork demand is holding its position, as demand is less sensitive to economic changes than other markets. Christine McCracken, senior analyst – animal protein at Rabobank, said: “Nevertheless, we see persistently high retail prices limiting consumption of all proteins. Consumers continue to conserve capital by shifting everyday purchases to lower-value protein options, switching channels, and moving to smaller pack sizes.

“Slowing supply in Europe will help balance the industry, yet high costs of production and limited consumer support will require a more conservative approach to production to stabilise margins.”

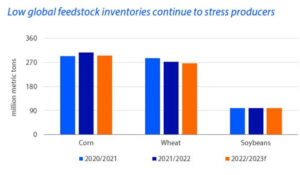

An improvement in production costs in 2023 has been forecast, however this could vary and risk management will be vital. Global feed stocks are at historically low levels, and availability remains tight. A disappointing Argentine harvest will partially offset Brazil’s record 2023 soybean and safrinha corn crops, leaving the market to focus on import needs, Black Sea grain availability (the current trade extension will expire in the coming months), and the successful planting of a new crop in the Northern Hemisphere.

Ms McCracken said: “Rabobank expects the small global cushion in grain and oilseed stocks to drive additional feed cost volatility in 2023.”

Adding to the volatility, recent outbreaks of African swine fever (ASF) in China, South Korea, the Philippines, and Europe have led to an increase in concerns over availability and trade interruption. Reactions to ASF outbreaks remain most disruptive in China and concerns about new losses led to farmers proactively culling hogs in late 2022 which continued to affect the rate of restocking in early 2023. Losses appear contained and remain regional which should limit market impact. Currently, global pork supplies appear sufficient, though a sizeable shortfall in China would disrupt the global industry and drive a sharp upward correction in pork prices.

Adding to the volatility, recent outbreaks of African swine fever (ASF) in China, South Korea, the Philippines, and Europe have led to an increase in concerns over availability and trade interruption. Reactions to ASF outbreaks remain most disruptive in China and concerns about new losses led to farmers proactively culling hogs in late 2022 which continued to affect the rate of restocking in early 2023. Losses appear contained and remain regional which should limit market impact. Currently, global pork supplies appear sufficient, though a sizeable shortfall in China would disrupt the global industry and drive a sharp upward correction in pork prices.

In other regions, improvements in biosecurity, genetics, and herd health are beginning to boost productivity. Herd health is improving in many markets as the impacts of porcine reproductive and respiratory syndrome (PRRS) and porcine epidemic diarrhoea virus (PEDv) begin to reduce. Improved productivity in the US and Mexico is expected to bring added supply and could potentially burden the market, as a rapid improvement in productivity could result in excess supply and require further industry adjustment.