Brazilian pork production is forecast to increase by 2.2% this year to reach 5.42m tonnes, marking the eighth consecutive year of production growth, the Brazilian Association of Animal Protein (ABPA) reports.

The first half of 2025 saw pig slaughtering increase by 2.5%, as lower feed costs and firm prices have improved margins, thereby incentivising farmers, while robust domestic and export demand have pushed up pig prices, AHDB analyst Soumya Behera said.

The latest livestock survey shows the number of breeding sows has increased marginally year on year to 5.0 million head (+0.6%) and is the highest record for breeding sows in the country.

The upward trajectory is expected to continue in 2026, with pig meat production forecast to touch a record 5.6 Mt, an increase of 2.4% year-on-year.

“Pork continues to be the third most preferred meat in Brazil, sitting behind chicken and beef. Consumer purchasing decisions in Brazil are driven by price rather than taste and chicken is still a preference over pork,” Ms Behera added.

Per capita consumption of pork increased progressively between 2024 and 2025 from 18.6kg to 18.7kg, and is likely to get a boost ahead of Christmas and New Year celebrations. Consumption is predicted to stabilise between 18.6-18.8kg levels next year.

Trade

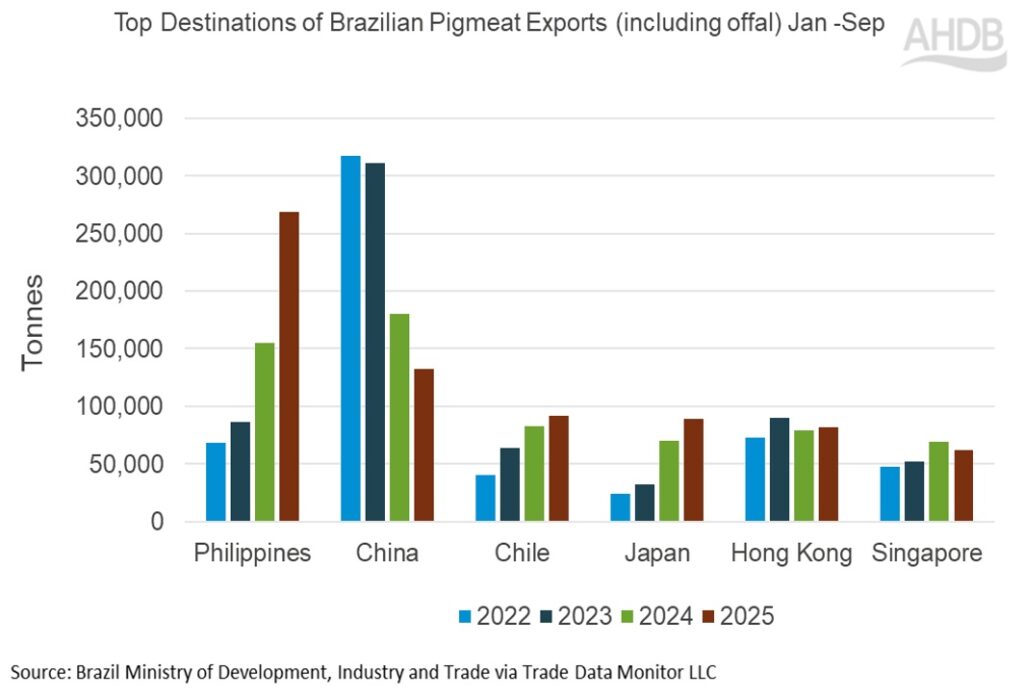

For the year to date (January to September), Brazilian pig meat exports (including offal) grew by a significant 16% year on year to a new high volume at 1.2mt.

Since 2019, Brazil’s pig meat exports have almost doubled in volume. Falling production costs make Brazilian pork cost competitive on the global market, thereby giving a boost to export demand, Ms Behera added.

This is further aided by currency devaluation. According to ABPA, exports are forecast to reach 1.45 million tonnes in 2025, an increase of 7.2% compared to 2024.

In 2025 so far, the Philippines has overtaken China as the top buyer of Brazilian pork, with volumes increasing by a significant 73% (113,000 t) year on year.

“China has reportedly rejected some pork and poultry import shipments from multiple countries, including Brazil. The issue coincided with announced anti-dumping investigations in July 2024.

Exports to Singapore have declined, while Japan has overtaken Hong Kong with a volume gain of 19,000t, while Brazil has recorded a ‘remarkable increase’ in exports to Mexico, Ms Behera.

UK implications

“Despite the slowing economy in China, offal continues to be a lucrative market. With Brazil losing market share to China amid tariff fallouts, there lies opportunities for UK exporters to further tap into this market,” Ms Behera said.

“The latest data for UK pig meat exports (Jan-Jul) show volumes to China have increased by around 21% compared to last year. Our market sources in China confirm that the UK is viewed as a preferred trading partner.

“However, one must keep in mind that with Brazil set to reach record pig meat production this year, Brazilian pork displaced from China will likely be diverted to other markets within Southeast Asia and the Americas. This will put additional pressure in other key UK export markets and we could see this weigh on prices.”