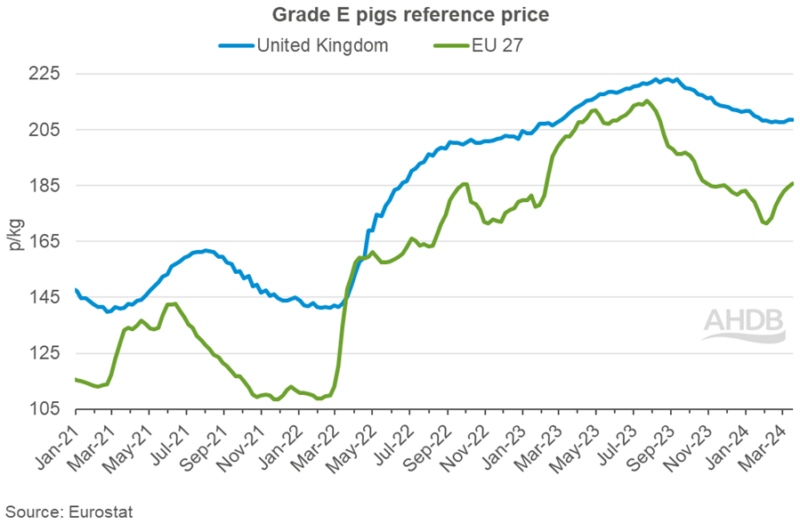

Improved demand has fuelled a welcome increase in EU pork prices over the past six weeks or so.

The first five weeks of the year saw EU pig prices drop off sharply, losing on average 12p/kg, on the back of seasonally weak demand. However, in the latest six weeks, ending March 17 prices have recovered, gaining 14p to average 185.63p/kg.

This has significantly reduced the gap to UK pig prices – the latest EU reference price was 23p behind the UK reference price – reducing the competiveness of EU pork imports.

All key producing nations have recorded strong growth in recent weeks on the back of tightening supplies, according to AHDB analyst Freya Shuttleworth.

“The driving force behind these price increases has been reported as an uplift in demand alongside the continued tightening of supply,” she said.

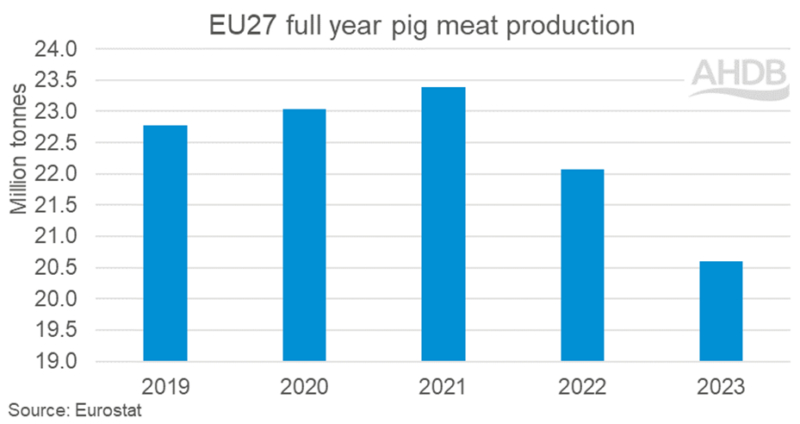

EU pigmeat production last year was the lowest volume recorded in over a decade, at 20.6 million tonnes, a 7% decline year on year, following a 6% fall in volumes in 2022. These declines have been driven by reduced slaughter numbers which are also back 7% year on year.

“Forecasts for 2024 predict further decline in pig meat production, with the contraction in herd size seen over the last couple of years not expected to recover,” Ms Shuttleworth added.

“In December 2023 the total pig population in the EU 27 stood at 133.6 million head, the smallest recorded population since records started in 2001. Pair this alongside incoming environmental regulations and the long term production outlook for the EU appears limited, with the EU commission forecasting an annual decline of around 1% between now and 2035.”

Trade dynamic

A challenging trade dynamic through 2023 may also have had some part to play in tightening pig meat supplies, Ms Shuttleworth added. EU exports of pig meat (including offal) saw significant year on year decline, standing at their lowest recorded volume since 2014, at 3.9 million tonnes.

“Much of this decline can be attributed to production losses, although some product may have lost out on key destinations due to increased global competition. However, this would not have been enough volume to outweigh the changes in production and imports,” she said.

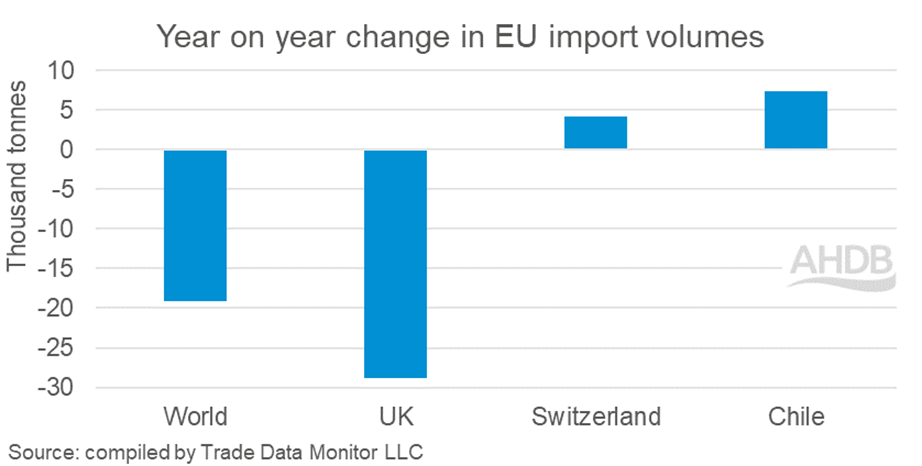

EU pig meat imports (including offal) totalled 146,800 tonnes in 2023, the lowest volume recorded in over a decade (excluding 2021 due to initial Brexit trade friction).

Despite the EU commission forecasting per capita consumption to fall 5% in 2023 as the increased cost of living impacted consumer spending, this volume drop in supplies available will have caused disruption to the market, raising prices paid.

These changing market dynamics have reduced the UK’s market share in EU import volumes. Historically between 80-85% of EU pigmeat imports were sourced from the UK – however, in 2023 it was sitting at 71%.

“Although the reduced shipments from the UK are mainly down to falling domestic supply, high pricing has not aided competition on the global market. Meanwhile import volumes from Switzerland and Chile to the EU grew year on year increasing their market share from 7% and 2% respectively in 2022 to 11% and 8% in 2023 respectively,” Ms Shuttleworth said.