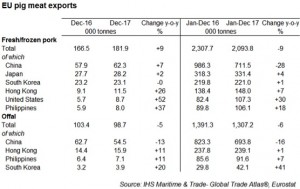

The latest statistics from Eurostat indicate that EU fresh/frozen pork exports returned to growth in December, gaining 9% on year earlier levels to reach 181,900 tonnes.

However, overall shipments in 2017 were still 9% lower than the previous year, at just under 2.1 million tonnes. With average unit prices higher than year earlier levels, the decline was reduced in value terms. At €5.1 billion, exports were worth only 3% less than 2016 levels.

As has previously been reported, the overall decline was driven by falling Chinese import demand, with shipments to this market declining by over a quarter for the year as a whole. However, the decline was partially countered by increasing exports to alternative markets, most notably the US and to a lesser extent Japan and the Philippines. Increased shipments of frozen bellies were key to driving growth in exports to the US last year, reflecting strong demand for this cut there.

Nonetheless, in the final quarter of the year, exports to China returned to growth. A 7% year-on-year increase in these shipments during December was the main contributor to the return to overall expansion during the month. This was also supported by continuing strong growth in shipments to the US and Philippines, as well as Hong Kong.

The advance in exports at end of 2017 partially reflects the fact EU export growth stalled at the end of 2016, as Chinese demand began to weaken. As such, volumes are being compared with a lower base. Nonetheless, shipments were still higher in Q4 than in Q3 this year. An increase in exportable supplies likely supported shipments towards the end of the year, while falling prices boosted competitiveness. Interestingly, the EU also managed to gain some market share on the key Chinese market at the end of 2017, with the US and Canada losing out despite offering lower average unit prices. This might bode well for EU export prospects this year. However, with North American production expected to expand further this year, competition on the Asian markets will likely continue to heat up.

Offal exports also followed a declining trend for the year as a whole, falling 6% on 2016 to 1.3 million tonnes. Again, higher unit prices meant the decline in value terms was smaller (-3%), falling to €1.7 billion. In contrast to fresh/frozen pork, shipments did not return to growth in December. China continued to receive over half of the total export volume, but shipments were down 15% year-on-year. However, as for pork, the Philippines proved to be a strong growth market. Notably higher volumes were also shipped to South Korea last year.