Pig margins tightened further in the first quarter of 2025, as feed costs increased and pig prices dropped back slightly.

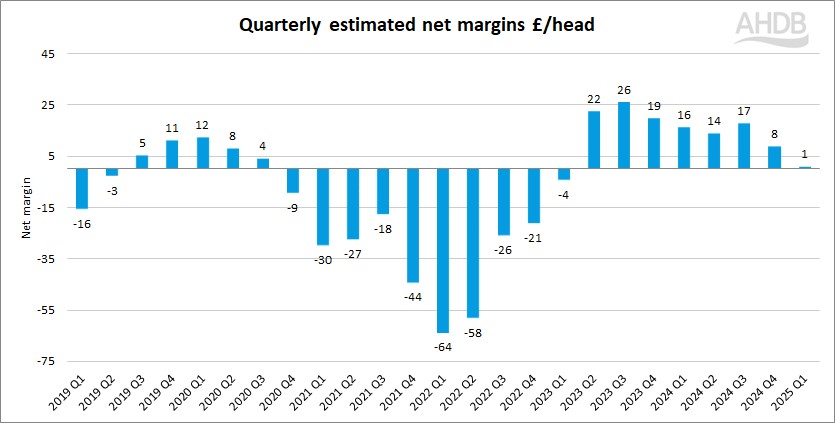

According to AHDB’s latest net margin quarterly estimates, which use performance figures for breeding and finishing herds, pig producers only just remained in the black over the first three months of this year, with net margins of £1 per head.

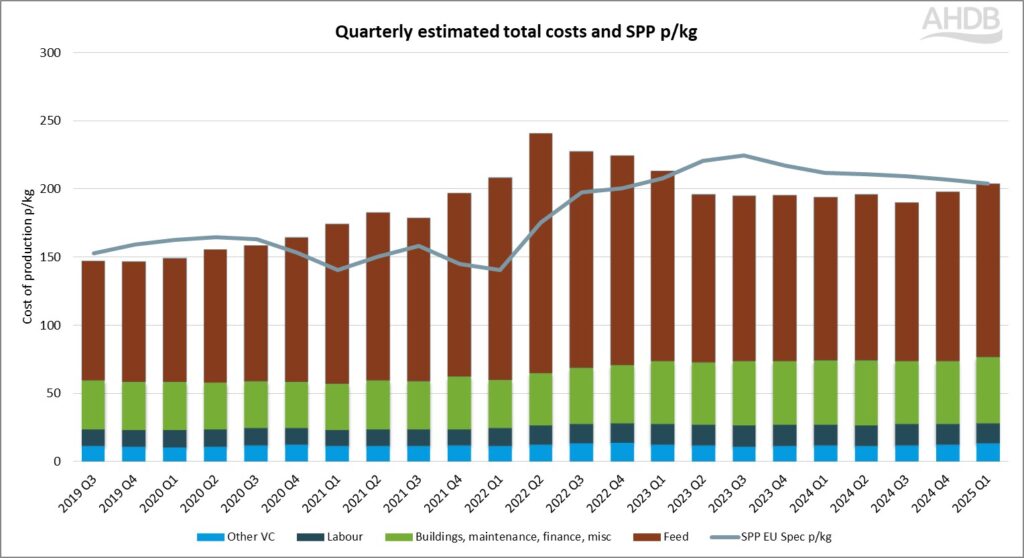

The full economic cost of productions for Q1 2025 is estimated to be 203p/kg, an increase of 6p from 2024 Q4.

Feed costs increased by around 3p to 127p/kg, accounting for an estimated 62% of total costs. Other costs such as breeding, straw and bedding and energy costs have also risen slightly this quarter, although fuel costs and interest rates decreased.

Over the three month-period, the SPP averaged 204p/kg, down from 207p/kg, as the market laboured through the early part of 2025, resulting in a net margin of just 1p/kg deadweight, equating to £1/pig.

However, the Q1 figures are not directly comparable to previous quarters as the figure was based on the SPP. Previously it was based on the APP, which was discontinued at the end of 2025. This change to SPP has caused a drop in margin of about £3/head, AHDB said.

But even given this, the Q1 figure is the lowest estimates since the end of 2022 and follows positive margins of £16/head, £14/head, £17/head and £8/head during 2024.

Nonethless, it represents the ninth consecutive month of positive margins, following on the back of 10 successive quarters of debilitating negative margins.

The situation is likely to have improved during the current quarters, as the SPP has risen slightly throughout April and wheat prices have fall throughout the quarter, so far.