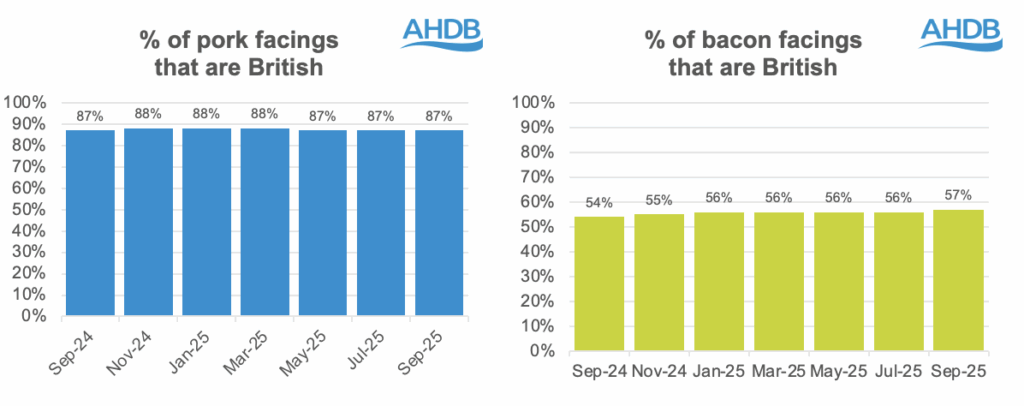

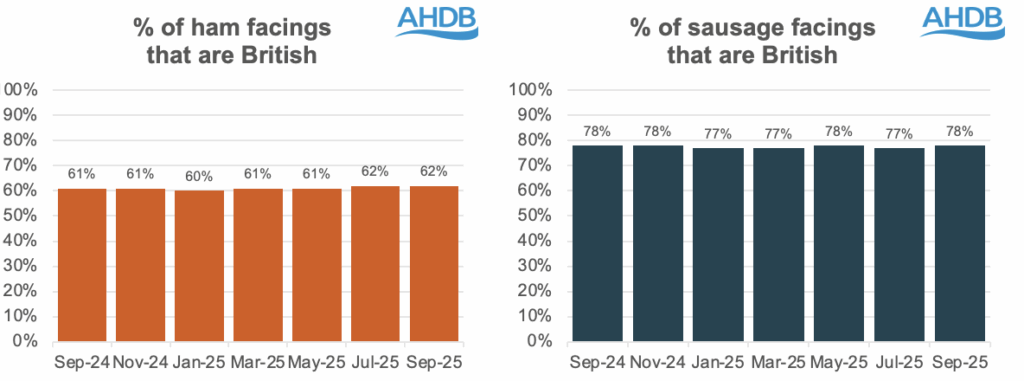

AHDB’s latest Porkwatch survey continues to show steady retail support for British pork products.

The proportion of British pork on display in September was unchanged on a year ago and on July at 87%, with Aldi, Co-op, Lidl, Morrisons, M&S and Sainsbury’s all 100% British and Waitrose on 99% (100% own label). Tesco was on 80%, Asda on 57% and Iceland just 1%.

The overall figure for bacon, at 57%, was up from 54% in September 2024, with Co-op, M&S (both 100%) and Waitrose (91%) leading the way.

The survey showed 62% of ham on display was British, slightly up on last year, with M&S (98%), Co-op (95%) and Waitrose (87%) again posting the highest percentages.

The overall figure for sausage, 87%, was in line with last year, with Aldi and M&S on 99% and Waitrose on 95%.

Retail pork volumes rise

Pork continues to perform well in the UK retail market, helped by the continuing high price of beef, according to the latest data from Worldpanel by Numerator UK, summarised by AHDB.

Overall retail pork volumes were up 2.6% to 208,000t in the 12 weeks to October 5, with total spend up 3.3% to £1.5bn, on the back of a 1.1% hike in average prices to £7.42/kg.

Primary pork volumes, where UK pork is strongest, were up 7.4%, with value up 9.9%, including a huge 35% rise in mince volumes, helped by lower prices.

Processed pork volumes were up by a more modest 1.8%, with value up 0.9%, including a 4.3% volume increase for sausages. Ready-to-cook volumes were up 26.1% and sous vide up 11.5%.

An 18% hike in beef prices to £10.37/kg over the same period resulted in a 7.2% decline in beef volumes to 118,500t but a 9.5% increase in value.

Lamb volume sales were down 16.7% to 14,900kg and value was down 13%, with average prices up 4.4% to £11.62.