The UK pig sector is in as strong a position as it has been for a long time, albeit against a backdrop of global uncertainty, troubles for the European pig sector and numerous challenges at home.

That was a clear message from last week’s well-attended Pigs Tomorrow conference that packed engaging discussion on a range of topics into a busy two days in Leicestershire.

The pig sector has enjoyed two good years of relatively high prices and manageable costs that have ensured a return to profitability, following a long period of crippling losses that cast a shadow over the conference the last time it assembled. The mood at this year’s event, which was attended by close to 250 people, was very different.

Opening proceedings with a comprehensive global round-up, Rupert Claxton, Gira’s meat and livestock director said: “I’m far more positive about the UK pig industry than I have been for probably a decade. It is in a really strong position. Consolidation continues and that’s maybe bad luck, if you are squeezed out, but it is giving us a real future and momentum to take us into the next decade.

“That investment at a retail and farm level is coming back in. That is really positive.”

Investing in British

Highlighting the longer-term approach currently being taken within the pig supply chain, Pilgrim’s Europe’s agriculture director, Fabio Brancher explained how his company is ‘investing in the future of the British pig industry’, including the provision of 20-year farmer contracts for new builds.

Pilgrim’s offering to farmers includes a commitment to farmers making a profit throughout the contract. Producers who rear pigs will be paid up to £15 per animal per animal per batch over the 20 years, plus a monthly management fee and bonuses for achieving targets at the end of the batch.

His presentation was followed by a panel discussion on the current state and resilience of the UK pork supply chain. It included a detailed summary by John Powell, Defra’s head of new Fair Dealing Obligations legislation about to come into force imminently.

Requiring written contracts from summer, the regulations will set out a framework to ensure fairer and more balanced supply chain relations than we have seen in the past.

NPA chairman Rob Mutimer welcomed the legislation, which he said had largely delivered what the industry asked for. He also highlighted the introduction of new cost-of-production-based long-term contracts from Sainsbury’s and Tesco that support farmers in meeting welfare and environmental requirements, as well providing financial security.

Challenges

But while the market and the supply chain might be in a better place, the conference addressed a number of challenges that the industry faces, including the national biosecurity threat, the shift away from conventional farrowing crates and the complexity of delivering environmental requirements, including the lack of single measure for calculating environmental footprint.

A common theme throughout was the importance of people to delivering on all of these aspects and the challenge of attracting and keeping quality staff. A highlight of the event was the Young Guns sessions that saw three young pig industry people speak eloquently and passionately about their roles in the pig sector and their belief in the sector as an exciting and rewarding place for young people.

Trump tariffs

Mr Claxton discussed the ins and outs of the impact of Donald Trump’s tariff regime on the global pig and the potential implications for the UK pig sector of the recently-agreed US-UK trade deal.

He said the use of feed additive ractopamine in the US would not be an issue under any future trade deal, as the US already has a ready supply of ractopamine-free pork that is exported. He also stressed that any future arrangements involving pork must be reciprocal, giving the UK equal access to US markets, if US pork comes into the UK.

“We could we do a trade deal that is beneficial for us. Could the UK get ribs and other products into the US market in return for bacon slicing? There are things that could be done – trade deals aren’t all necessarily bad. We need some two-way trade,” he said.

EU concerns

In contrast to the healthy state of the UK pig sector, he expressed concern about the EU pork sector

“With the exception of Spain, which is effectively on a flat line, we’re seeing a decline in pork production in nearly every EU market, certainly all the major ones. That trend is set to continue we don’t see any change in the mid-term,” he said.

He cited the pressures caused by environmental and welfare regulations, local planning problems around carbon emissions, disease issues and labour availability and succession, as the next generation are increasingly reluctant to follow in their parents’ footsteps, as the main drivers for the decline.

European slaughterhouses are struggling as EU pig numbers are down by around 25 million since 2021. As a result, plants are operating well below capacity, which was creating inefficiencies and forcing some closures, including two Danish Crown site and a Tonnies plant in recent months.

He said the current high prices for pigs being paid by EU processors were ‘unsustainable’, as they were being driven by low pig supplies and not demand and were not being passed onto retailers.

“So, the question is how is Europe going to restructure to be more efficient to make better use of expensive labour and to use automation effectively? You need scale,” he said.

“The EU must adjust to lower livestock numbers. Those numbers aren’t coming back, so they’ve got to find a new balance. There are likely to be more slaughterhouse closures and there’s a real chance that we’re going to need more imports into the European system.”

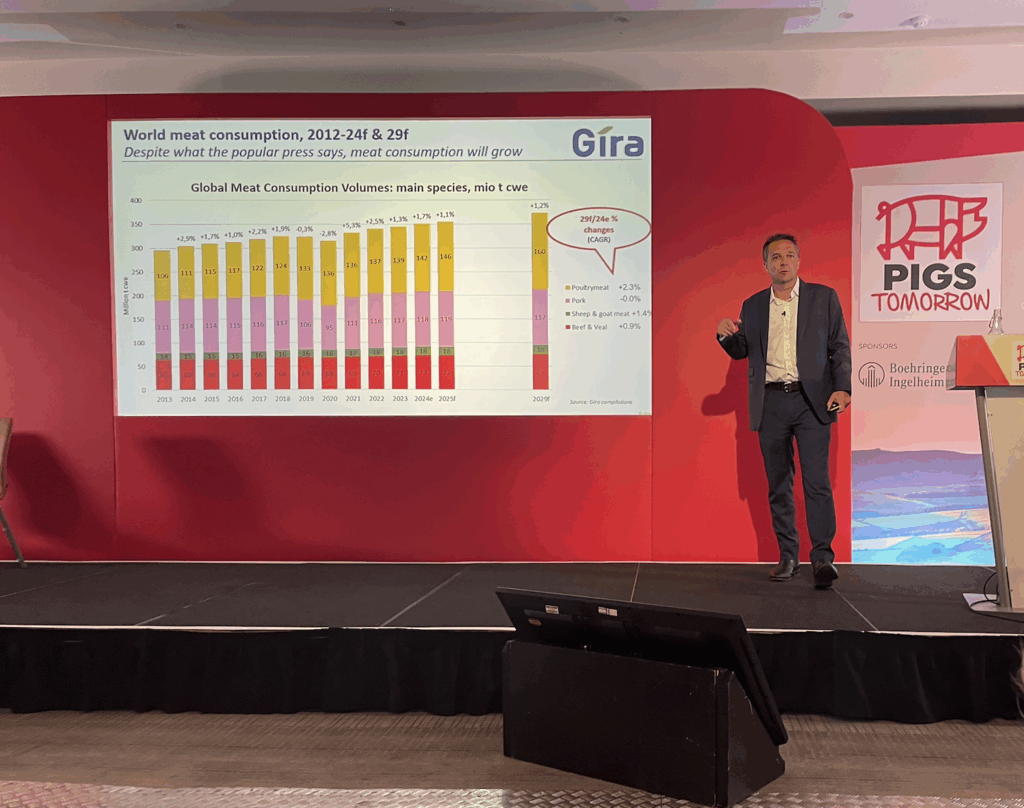

He said the global industry was benefiting from lower costs, tighter meat supply and ‘surprisingly robust demand, given the economic outlook’.

He stressed that, even though import volumes have fallen off since the 2020 peak, China remains an important market.