The traditional supply chains in the countries of the post-Soviet Union block have been largely unaffected by last year’s Russian embargo, but other factors have been at play affecting trade. In particular, the devaluation of the Russian ruble in the past year has led to some unusual consequences, with major players targeting the establishment of large-scale export sales while the home market is on the verge of deficit.

Both Miratorg and RusAgro have signalled the intention to export pork, with an eye on sending their production to the Asian market. Both companies have invited the Chinese veterinary service to visit and confirm compliance with that country’s strict veterinary controls.

Russian experts estimate that the average price of pork on the Russian market currently stands at 93p/kg, but even including logistics costs and import duties, the returns from selling pork to China and other Asian countries would be nearly 20% higher than selling it at home.

This move has been supported by the Russian agricultural minister, Alexandr Tkachev, who says that next year the country should export about 200,000t of pork and poultry to Asia. This position might seem strange given that these increases of deliveries of meat abroad will come at a time when there’s a deficit of pork on the domestic market.

Recent reports by Russia’s Accounting Chamber suggest that even despite the decrease in consumption from 10.8 million tonnes of meat this year to 10.5 million tonnes in 2016, the country may face shortages in some categories of meat production, including pork. The problem in the Russian market is that despite the efforts of the government, increases in domestic production are still not fully compensating for the fall in imports and depleting stocks.

For instance, in 2014 Russia produced 3.8 million tonnes of pork, and according to preliminary plans, by 2017 this figure should rise to 4.03 million tonnes. At the same time, because of the food embargo, Russia is expected to reduce imports of pork by 42% – about 450,000t – this year, and that figure could increase by another 100,000t to 150,000t in 2016. As a result, the overall volume of supplies to the domestic market could fall by 400,000t, and plans to send large batches of pork for export are only making the situation worse.

There’s a similar situation currently in Ukraine, where due to the active spread of African swine fever (ASF) the country could lose a significant share of pork production capacity, and even find itself on the brink of deficit of this product. Initially it was assumed that the country would produce 775,000t of pork this year, which is 1.6% more than 2014. However, the outbreak of ASF at a farm in Kiev Oblast in the middle of the year, as well as several other outbreaks at Odessa and Mikolaev Oblast, will most likely mean that instead of moderate growth this year, Ukraine experiences a moderate decrease.

At the same time, Ukraine has lost the ability to export pork. In September, an embargo on the export of food products to Crimea was introduced, while in November exports to Moldova were stopped due to veterinary restrictions. These two locations accounted for more than 95% of all Ukraine’s pork exports.

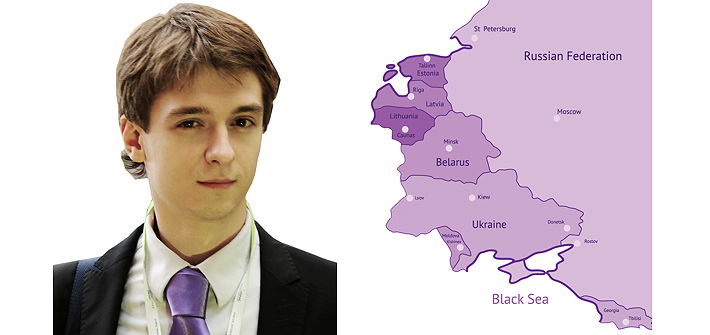

Meanwhile, the problem of ASF and the Russian food embargo continue to negatively affect the situation of pig breeding in the Baltic States. These countries hoped to replace banned supplies to the Russian market with alternative customers. Lithuania, for example, recently got the right to supply its pork production to the US.

In general, however, large parts of the region are included in the ASF quarantine zone where, due to disease, local pig farms will not be able to sell pigs outside the zone for some time. This puts pressure on domestic prices and negatively affects the investment climate in the sector.

ASF problems have also started to be felt in Moldova for the first time. After the outbreaks in southern Ukraine, Moldova’s veterinary authorities fear that next year the virus will enter their territory and may ruin the domestic pig industry.

On a brighter note, it seems that Belarus, despite the loss of a quarter of its pig population in 2013 due to ASF, could defeat the disease. There’s been no sign of the disease in the country for the past two years, and production this year is expected to reach 435,000t, which is 12.3% more than in 2013. The authorities expect that next year the growth rate in the Belarusian pig industry will be quite similar.