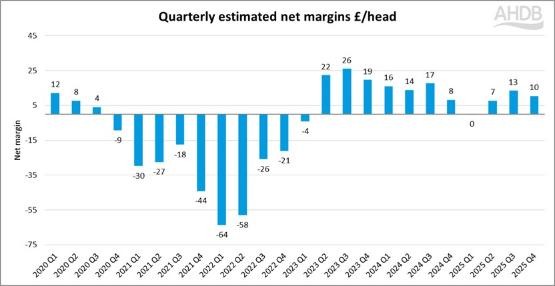

Net margins for pig producers slipped back during the last quarter of 2026 to around £10/head, as falling pig prices outpaced lower costs of production.

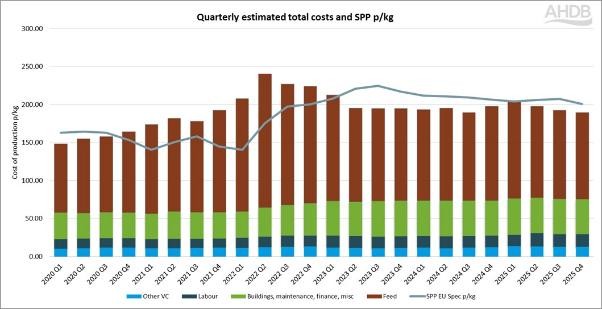

AHDB’s latest quarterly pork cost of production and net margin estimations, based on performance figures for breeding and finishing herds, estimate the full economic cost of production for Q4 to be 190p/kg deadweight. This was 2p below the figure for Q3 and 13p below the recent high of 203p/kg in Q1 2025.

The reduction was driven by a 2p fall in feed costs comnpared with Q3 to 114p/kg, representing 60% of total costs. Beyond that, there were minimal changes across variable, labour and finance costs.

However, pig prices, as messured by the SPP, averaged 201p/kg over Q4, a fall of 6p from Q3. This resulted in an estimated average margin per slaughter pig of £10.32, £3 down on Q3, and 11p/kg deadweight, 4p lower than in Q3.

The latest figures mean that average net margins have been in the black for 10 out of the past 11 quarters, the exception being break-even in Q1 2025 on the back of a spike in costs. This has brought some relief to producers after the debilitating series of 10 successive quarters of losses that preceded it.

However, the picture for the current quarter has worsened. While there have been no notable shifts in costs, the SPP has dropped back from 197p/kg at the end of 2026 to just over 190p/kg at the end of January.

- As of 2025, the cost of production and net margin figures have been calculated using the SPP price instead of the APP, which was continued in 2025.