With just over three weeks to go until the end of the Transition Period and a trade deal with the EU still hanging in the balance, AHDB has summarised the impact on input prices of new tariffs that could apply from next year.

Currently, any products that the UK imports from outside of the EU face the EU’s Common External Tariff, so a number of inputs already face tariffs and certain regulations.

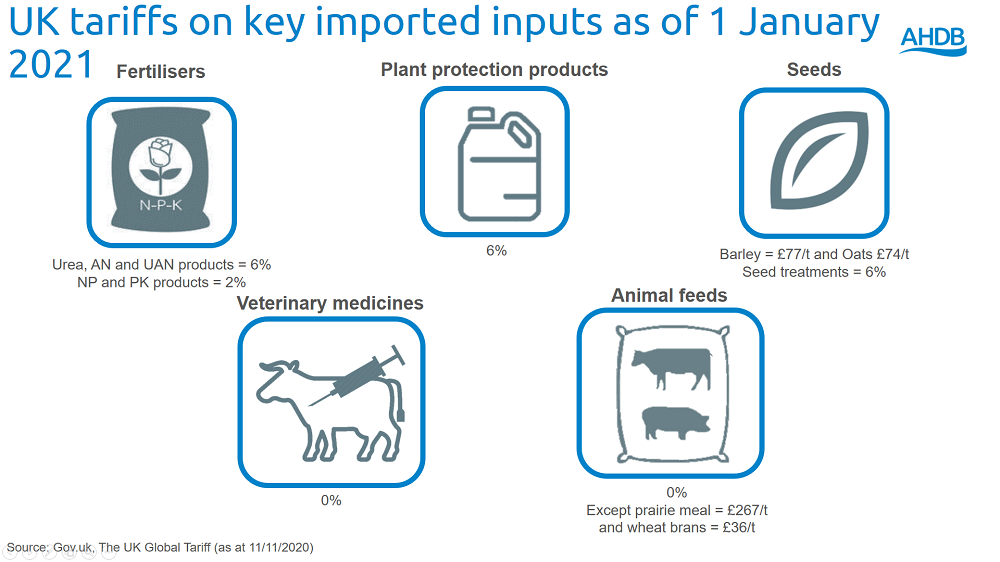

However, from January 1, the UK Global Tariff will replace this. All UK imports, regardless of source, would be subject to the tariff regime, which will result in some changes to tariff rates for certain products.

The big unknown, of course, is how our trade with the EU will look after January 1. If an agreement is reached, the UK Global Tariffs will not apply to the EU-27.

“There is also lack of clarity over the requirements at the border controls, and subsequently any additional administrations friction and costs that could be controlled,” AHDB analysts Mark Topliff and Felicity Rusk said:

“Finally, exchange rates will continue to have an influence, depending on the reaction of the money markets come the New Year.”

This uncertainty makes it very difficult to predict the overall impact of EU Exit, although the impact on individual business will be determined by when and how inputs are purchased and used, they add.

- The UK imports most of its fertilizer requirements from either the EU or countries such as Morocco, Algeria or Egypt.

- Imported urea, ammonium nitrate (AN) and urea ammonium nitrate (UAN) will be subject to a 6% tariff, down from 6.5% under the EU’s Common External Tariff.

- Imported nitrogen/phosphate and phosphate/potassium products will be subject to a 2% tariff, down from 3.2% under the EU’s Common External Tariff.

- The existing domestic framework which allows fertilisers to be sold in the UK will remain in place because it is separate from the EU framework.

- To ensure continued supply, there will be a time-limited period during which “EC fertiliser” could be placed on the UK market as now.

- All fertilisers currently marketed in the UK can continue to be imported and marketed in the UK provided they meet government requirements.

What you can do to prepare

The article sets out what producers can do to prepare for potential higher costs and supply disruption:

- As far as is practically possible, confirm or plan what inputs you may need in the coming months

- Speak to your suppliers now to see whether they anticipate any supply disruption or volatility with regards to any of those inputs

- Maintain regular contact with all your suppliers

- Any livestock producers stockpiling feed must ensure stores meet assurance scheme requirements. Talk through any planned changes to feeding regimes with feed advisers

- Use herd/flock health plans and work with prescribers to ensure that herd/flock animal health and welfare needs can be met during the months ahead

- You can find out more on AHDB’s EU Exit webpages.