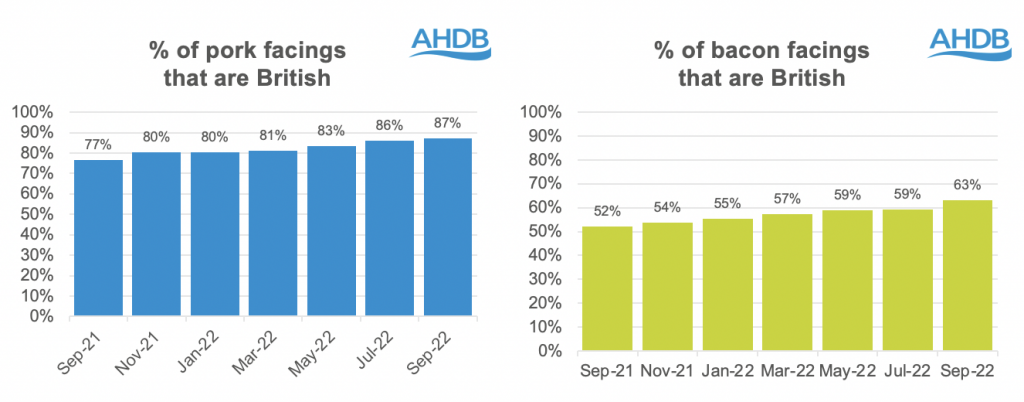

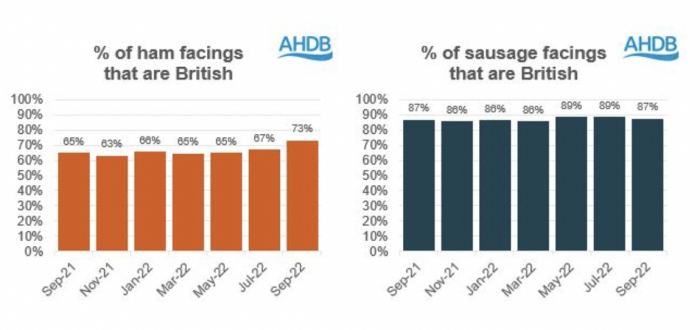

The big UK retailers are stocking a higher proportion of British pork products than a year ago, according to the latest AHDB Porkwatch data.

The September survey showed the proportion of British fresh pork on display on retail shelves increased to 87% from 86% in July and 77% a year ago.

The overall figure for British bacon was up to 63% from 59% in July and just 52% a year ago, while ham was up from 67% in July to 73%, compared with 65% a year ago. Sausage facings were slightly down on July at 87%, in line with a year ago.

Aldi, the Co-op, Lidl, M&S, Morrisons and Sainsbury’s all stocked 100% British fresh pork in September, with Waitrose slipping to 99% and Budgens at 98%.

Tesco and Asda were both still some way behind their rivals, particularly in the fresh pork and bacon categories, but they have shown significant improvements.

Tesco’s figure for fresh pork of 77%, was up from 55% a year ago, while its proportion of British bacon increased from 38% to 52%. Asda’s pork on display was 66% British, compared with 41% a year ago, while its British bacon facings have gone up from 29% to 43% over the year.

Strong supporters of British pork across the categories included M&S, which recorded 100% in all four product areas, while the Co-op was 100% for bacon, 97% for ham and 92% for sausage, and Waitrose recorded 97-99% for all categories.

Aldi recorded 100% on sausages and 82% on ham, while Lidl recorded 84% on sausage but below 50% for bacon and ham. Sainsbury’s showed generally good support, between 79% and 90% for the other three categories, while Morrisons was slightly behind at between 57% and 82%.

Imports

Pork import volumes were 16% up during the first eight months of this year, driven by higher bacon (+30%) and sausage imports (+24%), with fresh and frozen imports up 7%. However, import volumes in July and August were broadly on a par with last year, while exports were down 9% year-on-year in August.

While the comparison with 2021 is affected by the impact of Brexit disruption on trade last year, imports volumes are still up by around 6-7% on 2019 and 2020 levels.

The Porkwatch survey suggested retailers were stocking a higher proportion of pork, although the survey does not quantify volumes. It also does not include pork ingredients, for example in ready meals or pizzas, which could be contributing to higher import volumes, AHDB analyst Carol Davis said during the NPA autumn regional meetings.

The foodservice sector trends could also be a factor, as under-pressure consumers ‘trade down’, for example opting for a takeaway or fast-food, rather than a pub or restaurant meal, equating to cheaper cuts, often of imported meat, she suggested.

Stick with British

NPA chief executive Lizzie Wilson urged the supply chain to stick with British product, wherever possible.

“The latest Porkwatch figures are to be welcomed – and we are pleased that some retailers being more supportive of British pig farmers,” she said.

“But the survey only tells part of the story; the pig industry continues to be in a very precarious position and it is clear that there is still a lot more that could be done at processor, retail and foodservice level to support British producers and prevent permanent contraction.”