Chinese pork imports, including offal, were 20% up year-on-year, at 663,200 tonnes, during the first four months of 2023.

However, imports volumes remain significantly below volumes for the same period in 2021, at 1.56Mt, when its production capabilities were severely reduced from ASF, reflecting the ongoing recovery of China’s domestic pork production. .

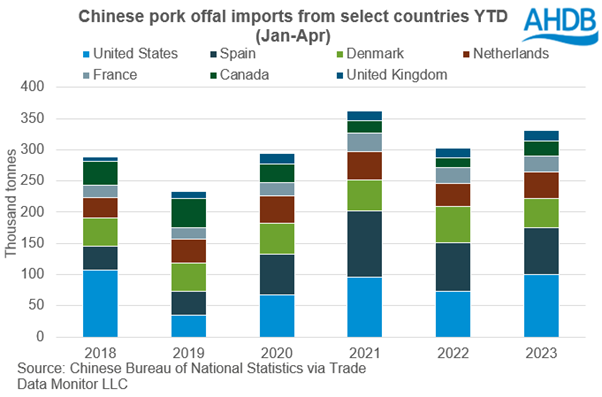

Offal imports have been maintained at similar levels year-on-year, totalling 362,900 t in 2023, this makes up 55% of total import volume.

“With disposable incomes remaining tight post-Covid, industry insight suggests we may be seeing greater demand for more affordable cuts of meat as foodservice demand recovers, keeping offal imports maintained,” AHDB analyst Isabel Shohet said.

Brazil saw the most notable increase with imports from January to April reaching 154,100t, up 42% from 2022 levels, making Brazil becoming the second largest exporter to China behind Spain (167,900t). Between them, they account for nearly half of China’s total pork import volumes.

UK pork exports to China from the UK totalled 27,350t over the period, 2% up on the year and the five-year average. The majority of this volume consisted of offal, which totalled 17,200t, a 4% increase year-on-year, and up 3,500 t (26%) on the five-year average.

“It remains to be seen if the demand for offal continues and how the UK can potentially increase its exports to China,” Ms Shohet added.

Chinese beef and sheep meat imports (Jan–Apr) are up year-on-year by 6.7% (37,200 t) and 21.1% (20,100 t), at 588,500 t and 115,300 t respectively. “However, this is partly due to COVID restrictions last year limiting the red meat trade, so we have seen imports increase on the year from a small base,” Ms Shoet added.

Production

China pork production is getting back to pre-African swine levels, increasing by 4.6% to 55.41Mt last year, according to official figures from the Chinese Bureau of National Statistics.

However, the USDA is predicting only a very marginal increase from that figure in 2023. The USDA reports that the Chinese pig slaughter is expected to rise to 701.5 million head through 2023, as production capabilities return back to levels seen prior to its African swine fever (ASF) outbreak. However, industry growth is expected to be limited by low prices hampering economic returns from production.

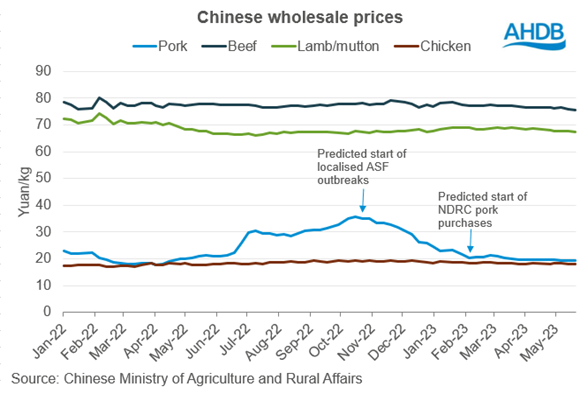

Chinese pig prices have fluctuated throughout the past 12 months, rising from May 2022 as prices to reach a high of just under 36 yuan (£3.95) per kg in October 2022to decline, down to 20 yuan (£2.19) per kg in February 2023.

Industry sources suggest that the localised outbreaks of ASF in winter 2022 led to the mass slaughter of pigs, driving up available supplies and reducing prices, Ms Shohet said.

The USDA has noted that the National Development Reform Commission (NDRC) in China began to bulk buy frozen pork from early 2023 to support pork prices and maintain an even supply, resulting in prices stabilising from February onwards.

“It is estimated that China produces and consumes around 40% of the world’s pork, it will be key to watch how demand and production develop in the coming months,” Ms Shohet added.

“Foodservice demand makes up a large part of domestic red meat consumption, and this market was heavily hit by the slowing economy during the pandemic.

“Whilst Covid restrictions were lifted at the end of 2022, and the pork industry is recovering from ASF, demand for red meat has not seen the resurgence that was expected. Market insights suggests cashflow remains tight, although OOH consumption is slowly recovering as the appetite for red meat increases.

“Overall, the predictions for China’s beef and pork market see that production is set to increase slightly, as we see a rebound in consumption and demand following ASF and Covid.

“Prices are set to remain supported throughout the year, but from a low base, which may discourage regrowth in herd sizes, while the threat of ASF still looms. However, for sheep meat, high inventories and limited demand are likely to limit sheep meat imports.”