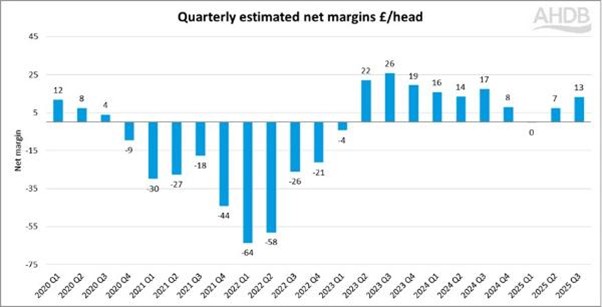

Average net pig margins nearly doubled to £13 per head in the third quarter of 2025, driven by a big fall in average costs of production, according to AHDB’s latest quarterly update.

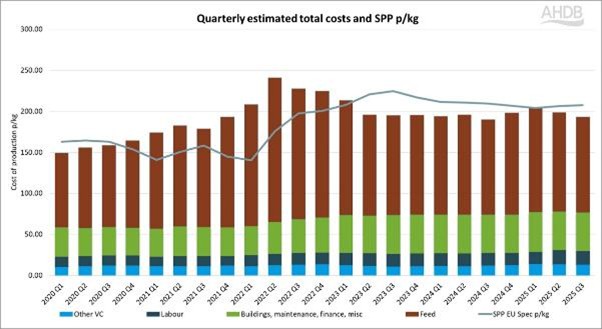

The full economic cost of productions for Q3 2025 is estimated to be 192p/kg deadweight, a significant decrease of 5p on the Q2 figure.

Feed costs declined by 4p to 116p/kg over the quarter, the joint lowest figure since Q4 2020, to make up an estimated 60% of total costs and accounting for the majority of the reduction. Finance and energy costs also dropped slightly this quarter, although an increase in straw and fuel costs partly offset this.

Pig prices increased slightly over the quarter, with the SPP averaging 207p/kg, as prices held relatively stable over the summer. This resulted in estimated margins per slaughter pig of £13.27 per head and 15p/kg deadweight, up from £7/head in Q2.

The industry has posted positive margins in nine of the past 10 quarters, the exception being break-even in Q1 2025. However, this followed the debilitating run of 10 successive quarters of negative margins, peaking at more than £64/head in Q1 2022.

As of this year, the cost of production and net margin figures have been calculated using the SPP price instead of the APP as that data series has not continued in 2025, which has slightly reduced the headline figures going back over the years. These estimates use performance figures for breeding and finishing herds.

After many quarters of relatively stable pig prices, the SPP had been falling in Q4, losing 4p since the end of Septembet, which will eat into margins, where farmers are not on fixed prices. Costs have remained relatively stable, however.