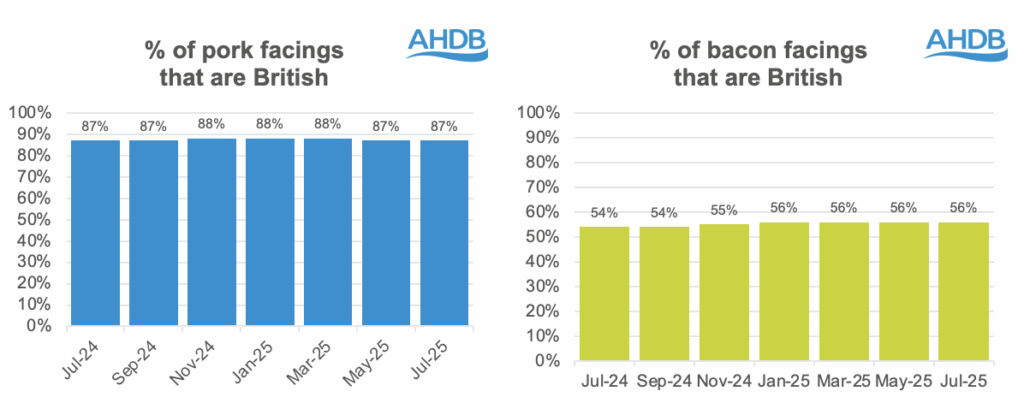

The UK’s big retailers continued to show decent support for British pork producers in July, according to the latest AHDB Porkwatch survey.

The proportion of British pork on display across the 10 retailers surveyed, at 87%, was stable compared with May and a year ago. Aldi, Co-op, Lidl, M&S, Morrisons and Sainsbury’s all sourced 100% British, with Waitrose on 99% (100% own label), Tesco, 79%, Asda, 58%, and Iceland just 1%.

The overall figure for British bacon, 56%, was also in line with May and slightly up on July 2024, with Co-op and M&S on 100%, Waitrose, 92%, and Sainsbury’s, 77%. The worst performers were Aldi and Lidl on 21% and Iceland on 14%.

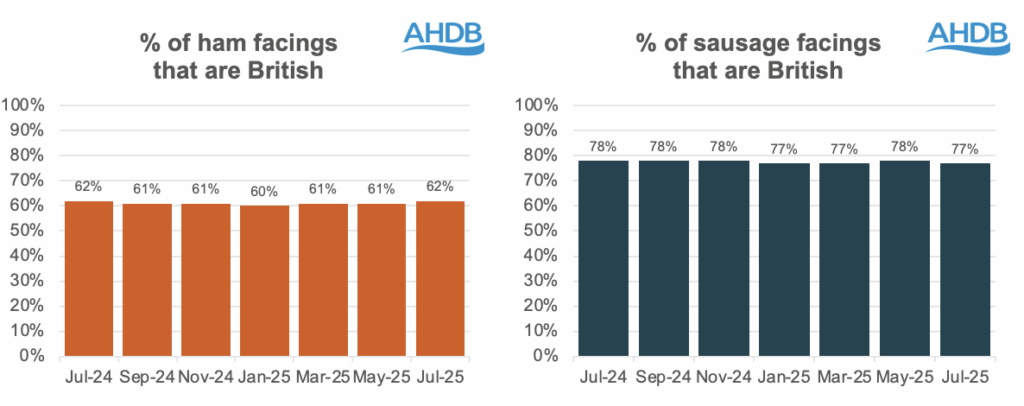

Overall, 62% of the ham on display was British, slightly up on May and in line year on year. M&S on 98%, Co-op, 95%, Waitrose, 88%, and Sainsbury’s 80%, were the best performers, with Lidl, 37%, Asda, 36%, and Iceland, 12%, the worst.

The 77% of British sausage on display was slightly down on May and July 2024, with M&S, 99%, Aldi,97%, Waitrose, 92% and Lidl, 91%, the biggest supporters of British and only Iceland, 48%, below the 50%-mark.

Retail sales trends

UK retail spend on pork products was up a healthy 3.2% year on year, with volumes up 1.4%, despite a 1.7% rise in prices, in the 12 weeks to July 13, according to the latest Kantar data, summarised by AHDB.

Even more encouragingly for the UK pork sector, spend on primary pork cuts was up 5.1% on the back of a 2.6% increase in volume and a 2.4% increase in price, with shoulder roasting volumes up 13.4%, mince up 14.9% and belly up 7.3%.

Overall processing volumes were down 0.5%, with spend down 0.3%, driven by a 6.6% year-on-year decline in bacon volumes, although sausages, +2%, and sliced cooked meats, +1.5%, were up in volume.

Volume sales of marinades, +22%, sous vide, +7.5%, and ready-to-cook, +2.9%, all saw growth.