A potential trade war between the EU and China could have major repercussions for the global pork trade, including in the UK, experts have warned.

China’s ministry of commerce (MOFCOM) confirmed in mid-June that it was launching an anti-dumping investigation into EU pork products. This followed an announcement from Brussels that it was introducing new tariffs of up to 38.1% on imports of Chinese electric vehicles (EVs) from July 4.

If it goes ahead, the investigation, which should be completed within a year but can be extended for six months, could ultimately result in new tariffs being imposed on EU pork exports to China.

China imported 1.55m tonnes of pork, including offal, worth US$6bn in 2023, with the EU accounting for about half of that. The threat of a trade war therefore sparked concern across the EU, particularly among the big pork exporters.

European Commission vice-president Valdis Dombrovskis and Chinese commerce minister Wang Wentao have begun talks in a bid to find a resolution.

It was reported today that Mr Dombrovskis told Bloomberg Television that talks with China were ongoing. “We are not seeing the basis for retaliation, as what we are conducting is indeed in line with WTO rules,” he said.

Increased tensions

AHDB senior analyst Soumya Behera said the increased tensions between the EU and China could have ‘major repercussions if it results in trade restrictions between the two nations’.

“The volume of pigmeat looking to find a new home on the global market would be significant and would likely trigger falling prices as the market adjusts. Exports of offal and fifth quarter currently help generate a higher value for the whole carcase, with China taking in product that has limited demand elsewhere,” she said.

Industry analyst Mick Sloyan said that, if substantial tariffs on pork exports to China are introduced, it could undermine EU exports and affect the internal EU market, with a disproportionate effect on countries like Spain that have built up significant business in China in recent years.

The UK is not directly affected by the dispute, but even if it decides not follow the EU and US in imposing tariffs on Chinese EV imports, it will not be insulated from the fallout if a trade war starts, he added.

“If punitive tariffs are introduced on EU pork and offal exports to China, this will leave a lot of pork that will either be exported elsewhere or absorbed on the EU internal market. That could add pressure on EU pig prices, which would soon be felt on the UK market,” he said.

NPA chairman Rob Mutimer agreed that the UK industry would feel the effects of new tariffs. “It would mean there would be an awful lot more pork on our market. We really hope a solution is found that avoids this sort of disruption,” he said.

Pig supplies

Pig supplies in China remain tight, after a significant contraction of the sow herd last year. According to the Ministry of Agriculture and Rural Affairs (MARA), the number of sows has declined by 6.9% year on year to 39.86 million as of the end of February, resulting in a tightening of fattening pig supply.

“There has been significant liquidation of sows due to disease outbreaks and financial pressure, with some further decline in the sow heard anticipated amid liquidation of smallholders,” Ms Behera said.

This decline in Asian pig production, of which China is the major contributor, is largely responsible for the Food and Agriculture Organisation of the United Nations’ (FAO) forecast for estimated global pigmeat production to decline year on year by 0.9% in 2024.

Imports

Overall Chinese pig meat imports, including offal, are in decline for the year to date (January to May), but this is almost all down to 48% year-on-year reduction in pigmeat shipments to 423,000t.

This is the lowest volume recorded since the African swine fever outbreak in 2018. However, offal import volumes continue to grow, up 2% year on year for the period, to 474,000t.

“Higher domestic inventories of frozen product are reportedly driving lower imports. Market interference is common practice in China. The Chinese government keeps a reserve of frozen pork to ensure supply and price steadiness,” Ms Behera added.

Despite volumes falling substantially from all key trading partners, the EU27 remains dominant, holding a 47% market share.

Spain has retained its position as the largest individual country exporting pigmeat, excluding offal, to China, while Brazil is a close second. Brazil continues to hold a competitive advantage of lower prices on the global market.

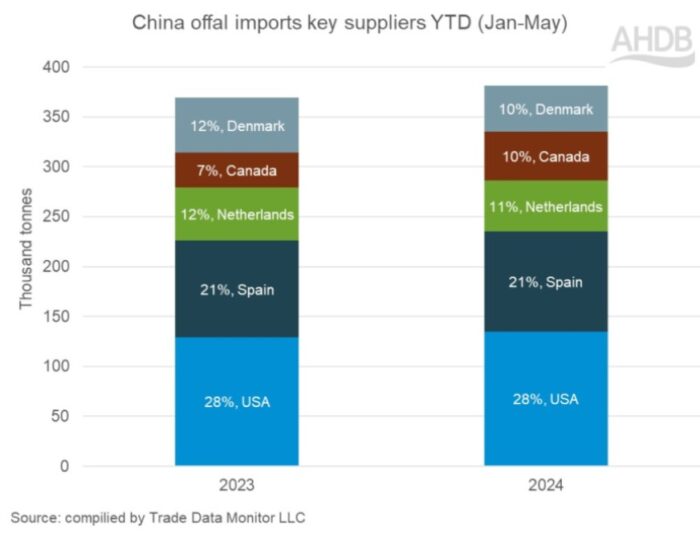

Looking specifically at the offal category, the EU27 also continues to dominate Chinese import volumes with a 51% market share. However, there has been some change seen in individual countries. The US and Spain remain the largest exporters, but the Netherlands and Denmark have lost market share to Canada.

UK exports of pigmeat to China, excluding offal, have declined, while offal shipments have increased, with the UK holding a 5% market share of both categories.