UK pigmeat import volumes continued to increase towards the end of last year, as the EU-UK price differential grew, making imports an attractive proposition to fill the gap left by domestic shortfalls.

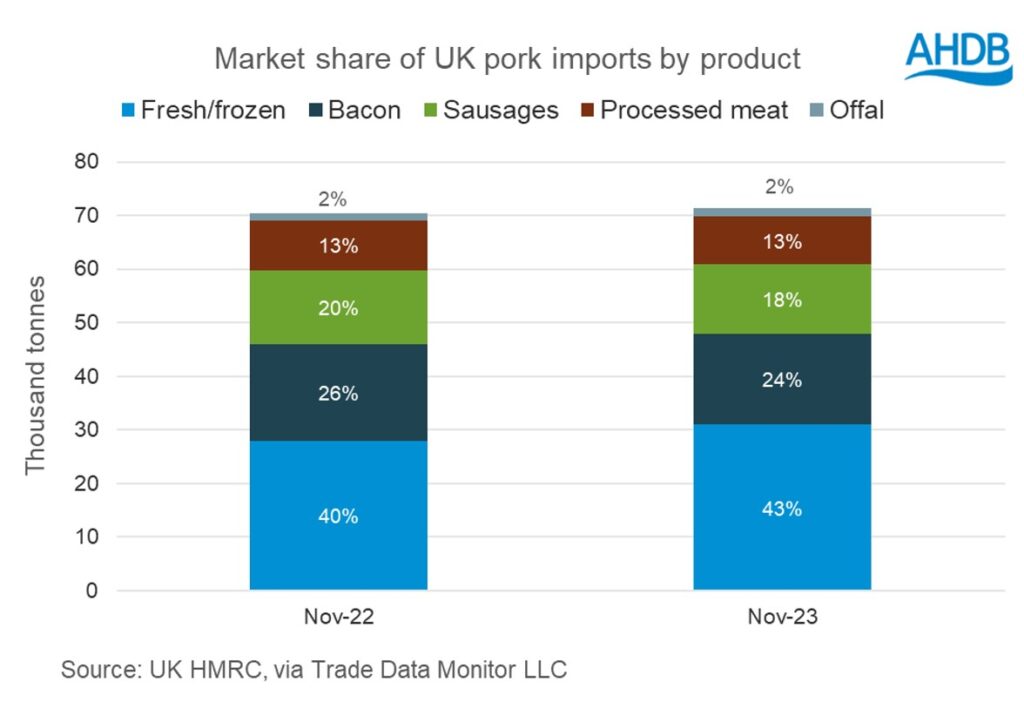

Pigmeat import volumes totalled 71,300 tonnes in November, up by 1,200t on October, the fourth month in a row of growth and 1,000t up on November 2022.

For the year to November, UK pig meat imports totalled 720,100 t, which was 2% (-18,100t) down on the same period in 2022. However, every month from May has seen a year-on-year increase.

During November, imports of fresh and frozen pork were 11%, 3,000t, up on November 2022. However, sausage imports were down 7%, 1,000t, bacon was down 5%, 900t and processed pork products were 3% lower.

AHDB senior analyst Soumya Behera said ‘multiple factors’ are contributing to the increase in import volumes, including lower domestic production, with the UK pig population recorded at its lowest level in over a decade.

“Lower European pig reference prices, which have been declining over the last few months, also remain key,” she said.

“The price differentials between UK and EU prices continue to support EU imports to the UK. In addition to this, demand factors have also played a key role.

“Retail volume purchases remain suppressed by 2.2% for the 12 weeks ending 26 November 2023. However, volumes in the food service sector have gone up by 7.2%, thereby uplifting demand in a category with greater exposure to imported product.”

Exports

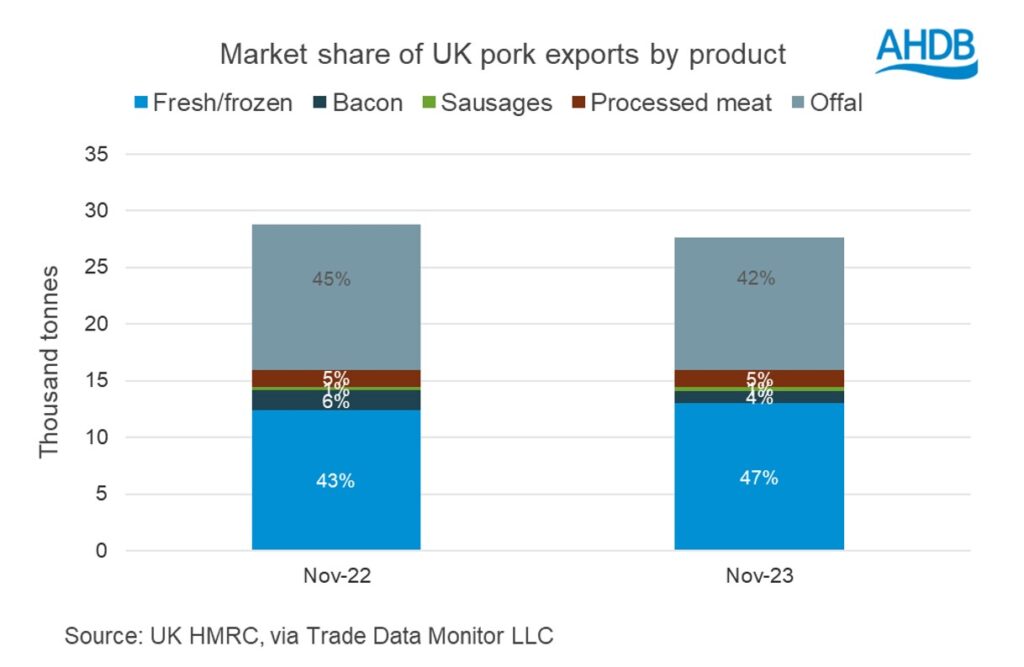

UK pigmeat export volumes remained below 2022 levels, due largely to production constraints, totalling 27,600 t in November, down 4% (-1,200 t) on November 2022.

Total pig meat exports year to November) totalled 275,900t, one of the lowest volumes in the last eight years and 19% lower (-65,700 t) compared to the same period last year.

All product categories saw year-on-year declines in November – except for fresh/frozen pork, where volumes have increased by 600 t. Shipments of offal have seen the largest volume declines, down 9% year-on-year to 11,700 t.

Exports of bacon have recorded a decline of 600 t (36%), while exports of sausages and processed meat recorded small changes.

Though exports to China, one of the major buyers of offal, have developed in the last two months, volumes continue to trend well below previous years.

Total exports to China were recorded at 10,800 t in November, representing 39% of the total export volumes, but 2%, nearly 300t, below November 2022 levels.

Shipments to EU-27 destinations declined by 1,100 t to 12,000 t in November compared to a year ago. The largest declines within the EU have been seen in shipments to Netherlands and France.

“The significant reduction in domestic production as mentioned above will be a factor behind this change. The gap between UK and EU pricing continues to make UK product less competitive on the EU market,” Ms Behera added.

“Demand remains challenged with consumers taking a cautious approach. Supplies available in the major exporting regions, domestic production and price points will be key as we look out across 2024.”