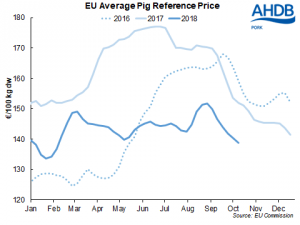

The EU average pig reference price has now been falling for six consecutive weeks, with the current figure the lowest since February.

For week ended October 14, the average price stood at €138.77/100kg, well below the average for the year to date. This is also €13 below the price a year ago, although the gap has been narrowing as prices were falling back at a faster rate this time last year.

Interestingly, six weeks earlier, the price had averaged over €151 which is the highest quote of the year. However, this could not be sustained. EU pig supplies remain relatively large while consumer demand is reported to be only average for the time of year, and hence the market has been pressured. Demand on export markets is also reported to be lower than expected, and of course the potential for African Swine Fever to spread remains a cause for concern.

Most major producers have recorded falling prices over the past month, though the drop has generally been more severe in southern member states. Spanish prices dropped by €15/100kg in the four weeks to 14 October, while the Portuguese and French quotes were down by €12 and €8 respectively. Further north, prices in Denmark and the Netherlands were only around €5 lower over the same period, although German prices did fall by more (-€9).

With the presence of ASF in its wild boar herd, prices in Belgium were particularly negatively affected and weakened by over €18 compared to four weeks before. Although, in more recent weeks they seem to have stabilised.

With some recent strengthening of the pound against the euro, and less dramatic declines in UK prices, the gap between UK and EU reference prices has widened to €27/100kg (24p/kg) in the latest week. This is a larger gap than for most of the year so far, and is also high by historic standards. Hence, UK product may be experiencing tough competition from the continent at the moment.

Further growth for EU pork production ahead?

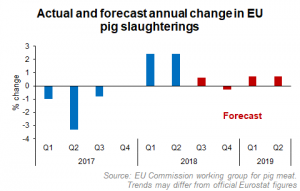

Growth in EU pig slaughterings is expected to continue in 2019, according to the latest figures provided by the EU forecast working group for pig meat.

Pig slaughterings are forecast to be relatively flat year-on-year in the second half of 2018, with growth returning at a rate of around 1% in the first half of 2019. Mixed trends are anticipated by the main producing member states. Germany and Poland in particular anticipate that pig throughputs will be lower than year earlier levels. However, this is outweighed by further strong growth in Spanish, Danish and Dutch output.

Interestingly, these forecasts are in contrast to the EU Commission’s Short Term Outlook report, published last week. This anticipates a 1.5% rise in pig production for 2018, and a 1.0% decline in 2019.

What might have influenced the differing forecasts?

The Short Term Outlook attributes the slowdown in pig production to the impact narrower margins are having on pig breeding herds. However, the herd reduction so far has not been particularly large (-0.7%). Given sow productivity follows a generally upward trend, this reduction in sow numbers won’t necessarily lead to a tightening in supplies. This sentiment is supportive of stable to increasing EU pork production early next year.

Nonetheless, there are downside risks. In June (when most EU mid-year pig census are conducted) rising feed prices were yet to squeeze producer margins significantly. With the impact of the extreme summer weather pushing the prices the price of wheat up from Q3, finances may become increasingly difficult for many producers. On top of this, there are growing concerns over the potential spread of ASF. These factors could potentially lead to herd decline accelerating in the coming months, depressing throughputs later next year.

The working group’s figures also indicate a more difficult six months ahead, with prices forecast to remain below year earlier levels until the second quarter of next year. In fact, over the six months to March 2019, prices are anticipated to average €137/100kg. This reflects concerns that supply will exceed demand across this period. Reports also suggest processors are reluctant to store pork in case of ASF spread and the sudden implementation of trade restrictions, which could exacerbate the situation.

Despite these concerns however, there is still some optimism in the industry that could inhibit the downside risks. There is the potential for Chinese pork import demand to increase next year, due to its own ASF struggles. The EU in particular is well placed to capitalise on this potential trade outlet, considering prohibitive tariffs currently in place on US product. As such, the outlook for the second half of 2019 is perhaps more positive. Time will tell how producers respond to challenges in the coming months, and the extent of any opportunity that arises.